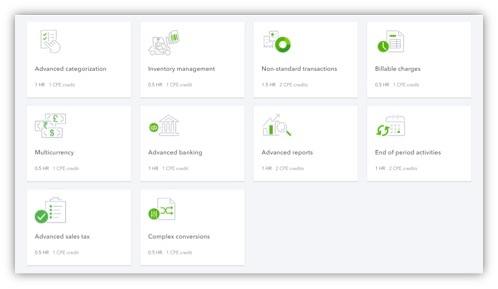

Advanced certification tackles many of the real-world scenarios every business owner and accountant will be forced to tackle at some point in time. As Intuit continues to roll out new features, most of the training courses end up in the advanced section. Examples of topics covered include the following:

- Advanced categorization methods using class tracking, location tracking and job costing through Projects.

- Non-standard transactions, including bounced checks, customer deposits, prepayments and refunds – challenges that often stump your clients. Zero-dollar sales receipts, progress invoicing and vendor payment can also be difficult to track correctly at first.

- Billable charges are a powerful way to track all your time and expenses to specific clients or projects.

- Advanced Sales Tax is probably my least favorite topic to discuss, but who really likes sales tax?

- Advanced Banking is by far my favorite feature of QuickBooks Online! Master these and you will be able to save an enormous amount of time. Check out our three-part tutorial on QuickBooks Online Bank Feed Rules.

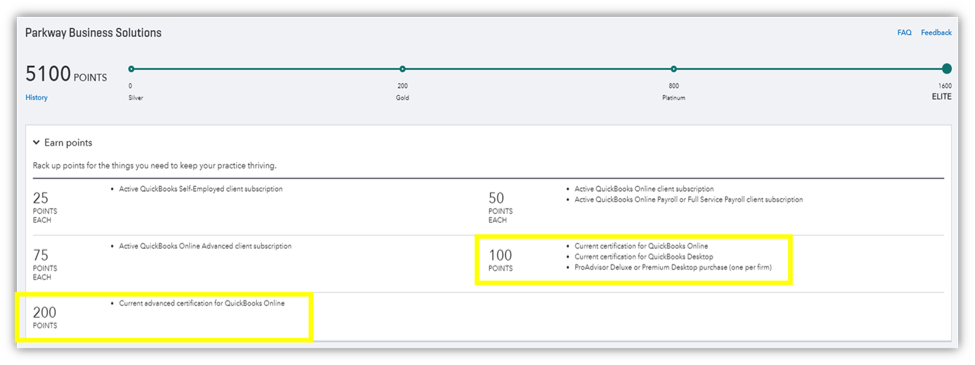

Additional points for Advanced Certification

Advanced certification provides the largest point increase possible, while growing your practice and increasing the benefits you receive as part of your membership. A standard certification adds 100 points per person that holds it within your firm. An advanced certification generates 200 points per person. For example, at Parkway Business Solutions, we have three employees as part of our firm. Based on our certification levels, we have 700 points just from our certifications alone!