Here are some examples:

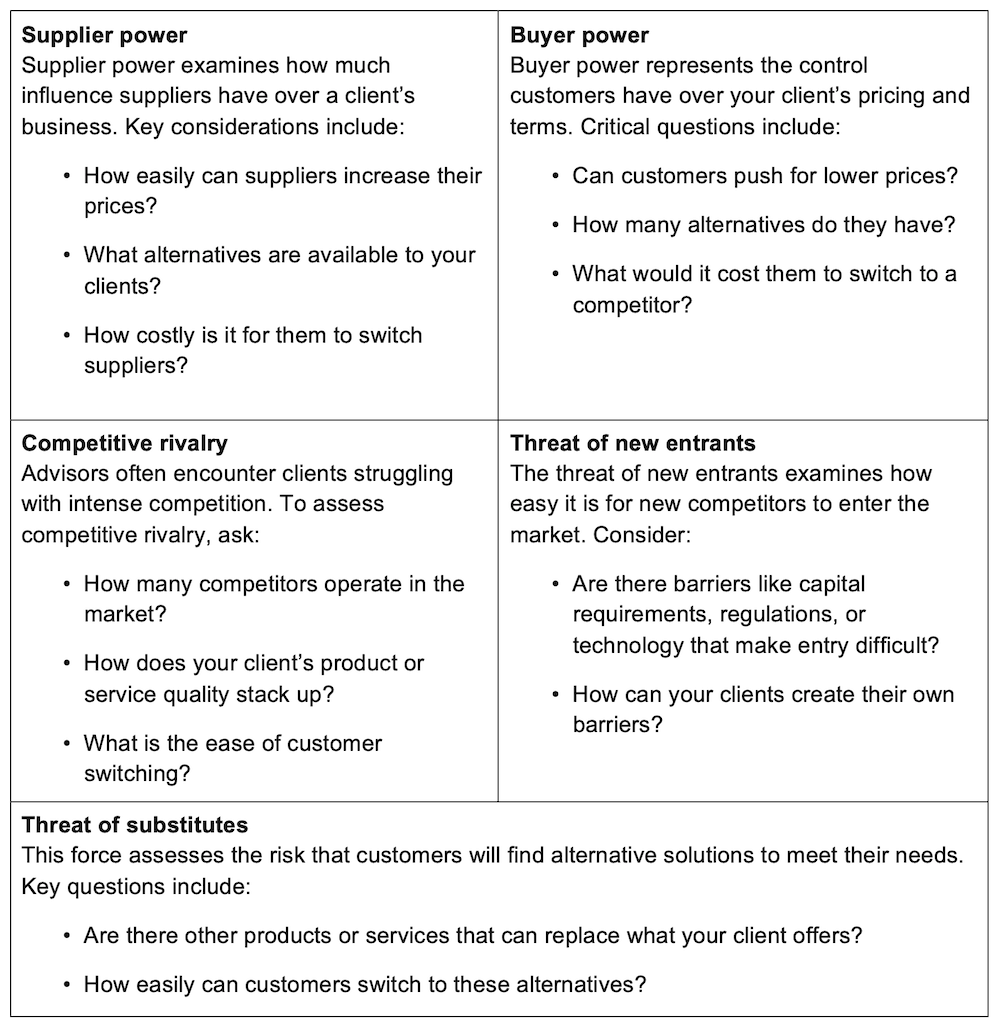

Supplier power: Assess existing contracts and identify opportunities for better terms. Can your clients source from additional suppliers to increase their leverage?

Buyer power: Help clients build loyalty and differentiate their offerings to minimize customer pressure on pricing. Bookkeeping insights can help track customer behavior and identify opportunities for improvement.

Competitive rivalry: Guide clients through competitive analysis, identifying unique strengths they can capitalize on. A fractional CFO can offer strategic advice on investing in key differentiators.

Threat of new entrants: Help clients create barriers to entry, like proprietary processes or strong brand presence. This can be particularly valuable for clients in industries with low startup costs.

Threat of substitutes: Encourage clients to innovate continuously and adapt to market trends. Effective forecasting can help anticipate shifts and position their offerings accordingly.

Real-world examples: Resilience through cash flow management

To illustrate how Porter’s 5 Forces can be used to build resilience, let’s look at how companies have applied supplier power to their advantage:

Sleep Country’s strategy

Mattress retailers, such as Sleep Country, leveraged their strong market position to improve cashflow:

- They collect payments from customers upfront, reducing cash flow risk.

- They negotiated extended payment terms with their suppliers, meaning they hold cash longer before paying their bills.

For advisors, this example is a clear demonstration of how understanding supplier power can allow clients to create cash flow buffers. It shows how advisors can work with clients to structure contracts that delay cash outflows while accelerating inflows.

Dell’s Direct model

Dell’s approach also exemplifies the power of supplier negotiations. Because it’s so big, it can:

- Collect payment from customers at the time of order, receiving cash immediately.

- Pay suppliers on 60- to 90-day terms, allowing them to manage cash flow more effectively.

Advisors can learn from this by recommending similar strategies to clients, especially those with high-volume sales. Structuring payment terms strategically can make a substantial difference in a client’s ability to withstand economic fluctuations.

Challenge yourself

By understanding and applying Porter’s 5 Forces, advisors can help their clients make more informed decisions, build financial resilience, and maintain a competitive edge in the marketplace. As a trusted advisor, your ability to translate these insights into practical strategies can make all the difference in guiding your clients through market challenges.