For better or worse, HBO's hit drama "Succession" has raised the nation’s consciousness about the once sleepy topic of estate planning. According to Cerulli Associates, an estimated $68 trillion in assets will shift from Boomers to younger generations in the coming years. Meanwhile, LegalZoom research found that nearly 56% Americans believe that estate planning is important, but only one in three (33%) have documented their end-of-life plans.

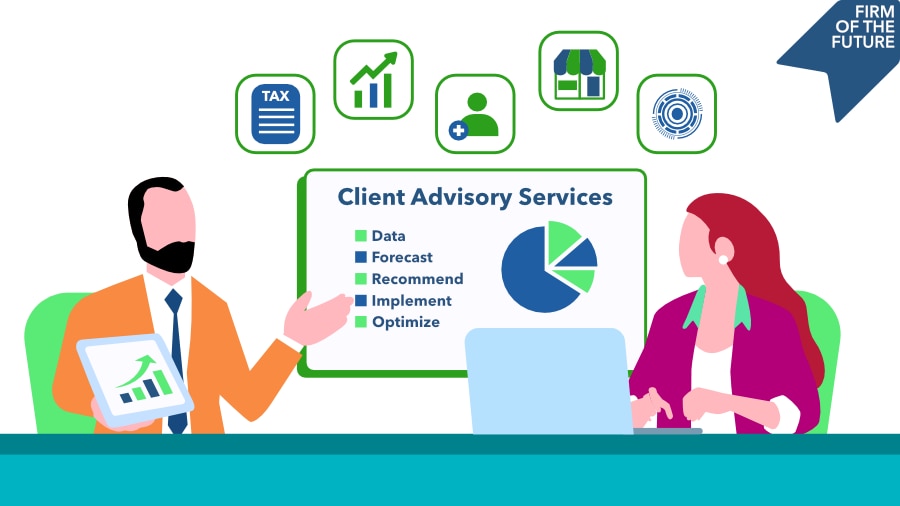

Your clients may not have billions at stake like the fictitious Roys in Succession, but this massive transition and lack of preparation for it represents a unique opportunity to provide clients with highly valued estate planning guidance, offering what I refer to as a "Family Office Level of Care." We are seeing a democratization of the family office model, with tax and accounting firms integrating forward-looking services such as tax planning, financial planning, and estate planning.

Why don’t more Americans have an estate plan

A Caring.com study revealed that two thirds of high-income individuals tend to delay the estate planning process due to the reluctance to meet with, and pay, high-priced attorneys, as well as the morbid topic of death and a significant amount of paperwork involved.

However, technology is now offering a solution and opening the door for wider adoption. By embracing these technological advancements and incorporating them into their practice, you can simplify the often complex and daunting estate planning process for your clients.

Digital platforms, such as Trust & Will, have streamlined the estate planning process and offer a user-friendly digital experience, enabling lay people and their advisors to complete basic estate plans on their own. As your client’s most trusted advisor, you already have much of the financial information required to complete the plan on these digital platforms.

An estate plan is recommended for anyone who owns assets, such as real estate, cars, cash, or other property, regardless of the size of those assets. And it is not only for the wealthy; everyone has an "estate" to some extent and can benefit from careful planning. But Caring.com found that one third of Americans believe they don’t have enough assets to pass on to their heirs. If your clients have a home, tangible assets, or children, an estate plan can ensure their desires for the future are clearly outlined and legally protected. Even if they don't have substantial assets or children, an estate plan can still be beneficial. For example, it can articulate a client's wishes through healthcare directives and even indicate guardianship for a pet.