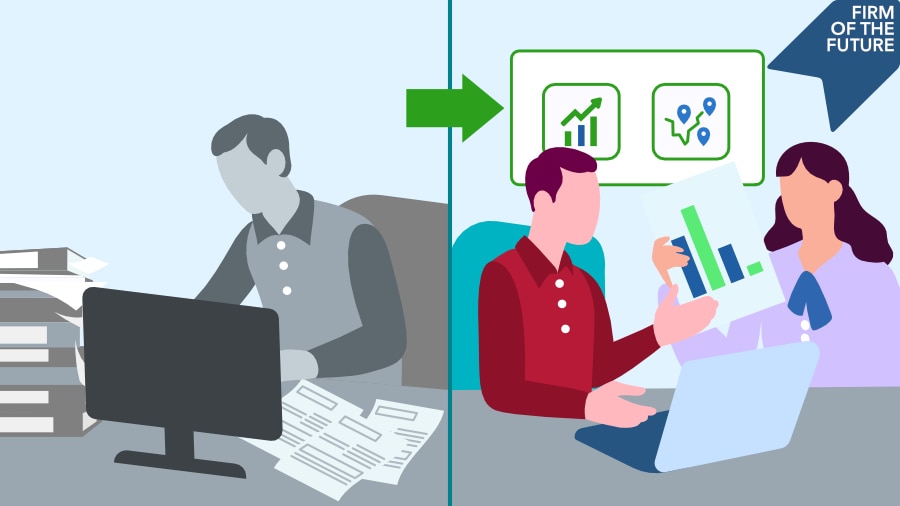

The accounting profession is transforming. Technology, client ecosystems, and evolving client expectations are reshaping what it means to provide value as an accountant.

Tasks once considered essential—bank reconciliations, journal entries, and payroll—are being automated. Clients are no longer content with transactional services; they’re looking for advisors who can provide strategic insights and help drive their success.

If you’re still focused solely on traditional accounting, it’s time to reconsider. The stakes are high, and failing to adapt to this new reality can have significant consequences for your firm.

Why transitioning to advisory services is essential

Avoid the gross margin “slippage.” As automation takes over routine accounting tasks, clients begin to disvalue these services. They see less need to pay a premium for work they believe technology can handle for less. This shift leads to declining gross margins for firms that rely heavily on transactional services, creating a financial strain that’s difficult to overcome.

Worse still, automation is a double-edged sword. While it eliminates time-consuming tasks, it demands constant investments in new technologies and staff training. Keeping up with these advancements can be costly, especially when correlated with the human capacity required to train staff effectively.

Retaining your position as the trusted business advisor. Perhaps the most critical risk is losing your role as your client’s go-to advisor. If your clients aren’t using your services for advisory, someone else is providing them with those services. The firm or individual providing advisory services naturally becomes your client’s new “Center of Influence,” guiding their financial and operational decisions.

Once this happens, your traditional services are no longer safe. The advisory firm can easily take over tasks such as bookkeeping and tax preparation, leaving you in the precarious position of being a backup provider. Staying in your client’s advisory seat ensures your influence, relevance, and long-term value.

The path to transition: Taking action now

Transitioning to advisory services doesn’t have to be an overwhelming process. Here’s how to start making the shift:

- Understand your client's needs: Advisory services aren’t a one-size-fits-all solution. Start by assessing your client’s pain points and goals outside of debits and credits. What do they value most? Use surveys and direct conversations to uncover the services that matter to them.

- Build a sales pipeline and process: Advisory engagements are often shorter and project-based, requiring a steady pipeline of clients to maintain revenue. Establishing a strong sales process ensures you’re consistently bringing in advisory work while retaining your core client base.

- Experiment with advisory offerings: Begin with small, value-driven projects, such as financial health assessments or operational reviews. These initial successes will build credibility, helping you expand your advisory services over time. You just have to find your sweet spot.

- Shift your pricing model: Advisory work often resists fixed pricing, requiring flexible or value-based approaches. Align your pricing with the value delivered while ensuring profitability through cost structure analysis.

- Invest in staff training: Transitioning to advisory services demands a different skill set. Equip your team with the tools and knowledge they need to excel, from financial analysis to communication and strategic planning.

Consequences of staying traditional

If your firm fails to embrace advisory services, the consequences can be severe:

- Gross margin decline: Clients will continue to devalue transactional services, driving down your margins and putting pressure on your bottom line.

- Rising costs: New technologies require ongoing investment in staff training, which becomes increasingly costly as automation and system integration complexity grows.

- Loss of influence: Without advisory services, your standing with clients erodes, leaving you vulnerable to firms that position themselves as strategic advisors. These firms can eventually take over your traditional services as well, leaving your firm at risk.

The message is clear: Transitioning to advisory services is not just an opportunity, it’s a necessity for the firm of the future.

Recap: Why transitioning matters

- Stay competitive: Keep pace with industry changes to meet client expectations and outpace the competition.

- Become an expert: Know the current issue and future outlook of your client's industry. Be seen as the expert and be compensated for that value-add.

- Protect your margins: Avoid the financial risks of a declining reliance on traditional services.

- Retain your clients: Solidify your position as a trusted advisor, ensuring long-term relationships.

- Future-proof your firm: Build a business model that thrives on strategic services, not just routine tasks.

Ready to make the shift?

The future of accounting lies in advisory services. It’s time to move beyond transactions and become the strategic partner your clients need. Start small, focus on understanding your clients’ ecosystems, and experiment with advisory offerings. By taking action now, you can secure your firm’s position as a leader in the profession while avoiding the risks of falling behind.