When Apple released the iPhone in 2007, the world turned upside down, and today, most of us can’t imagine navigating our personal or business lives without a smartphone. Technology has changed everything we do, from ordering food to filing taxes. We communicate with our family, colleagues, and clients through many channels, including email, phone, video conferencing, texting, and instant messaging apps.

Whether we like it, technology constantly changes how we work. When it comes to your firm, implementing the right technology and leveraging the benefits of those tools can dramatically improve your workflows and customer experience. So let’s talk tech!

Rather than comparing and contrasting the granular features of various accounting apps, let’s stay at 30,000 feet by exploring an overall strategy for building your firm’s ideal app stack. An app stack is a unique combination of technology used in any business. Accounting apps work together to facilitate the information, reporting, and compliance carried out by a firm, providing a family of services or ecosystem of tools that help your team to provide a more efficient delivery of services to your clients.

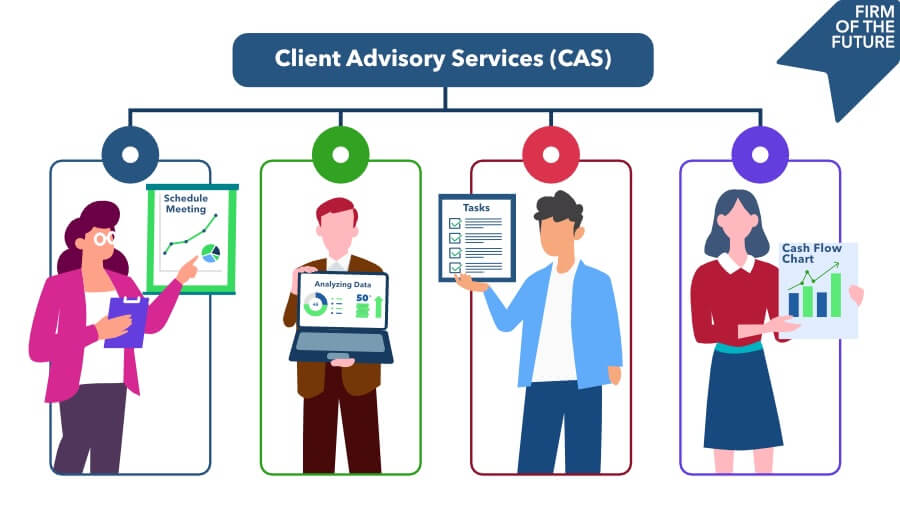

The main goal of an app stack is to allow data and information to flow freely with as little manual intervention as possible. To help with this, your firm may use some apps internally, so the client never sees or interacts with them; these are “advisory apps.” Other client-facing apps provide access to specific information and processes; these are known as “financial apps.” Some crossover exists between these two classes, which we will cover in our discussion on app integration.

- Advisory apps are used inside the firm to track and manage the firm’s tasks, all the way from the initial sales call to the completion of work. Advisory apps also deliver reports, graphics, and other data visualization in client advisory meetings.

- Financial Apps are tools clients use to process and record bookkeeping and accounting functions. Financial Apps integrate with your clients’ operational applications, providing a comprehensive solution for their financial and operational activities. Be sure to check out the QuickBooks App Store dedicated to apps Intuit has vetted and approved. In addition, the app store now includes accountant-approved apps. Of course, determining which works best for your firm and unique clients is the purpose of this article.