Key applications of AI in client advisory services

These case studies of how firms are leveraging the role of AI in accounting and finance show that the key to success is looking beyond the basic applications of AI in accounting. By using this technology to automate invoice processing or reduce human error in accounting processes, firms can focus on richer advisory services, including the following:

Forecasting and scenario planning

Accounting firms are revolutionizing cash flow management by deploying AI tools that combine multiple technologies to deliver more accurate and timely forecasts and insights. Where traditional cash flow analysis might take days and risk human error, AI-powered systems similar to Armanino’s cash flow model can process tens of thousands of transactions in minutes. This capability helps clients identify emerging cash flow challenges, prioritize collections and payments, and make more confident decisions about investments and expenditures.

Beyond the raw speed advantage, these AI-powered tools and services offer other benefits to clients:

- More granular understanding of their financial position.

- Earlier detection of potential cash flow challenges.

- Better alignment between stakeholders through accurate projections.

- Proactive management of operational expenses and overhead.

Predictive analytics can also aid in scenario planning, allowing firms to help their clients explore the potential outcomes of various strategic decisions. For example, Clockwork, an AI-enabled FP&A (financial planning and analysis) software, shared one case study where a firm, GeneralCents Accounting, used the tool to illustrate to a client what the financial impact of a small pricing change and team restructure might be based on financial performance and projections, ultimately helping boost that client’s bottom line.

Tax planning

The RSM case study with Additive is one example of how a firm might benefit from integrating AI into its tax advisory services. In that case, AI helped the firm provide tax solutions with reduced manual errors, while accelerating data processing and analysis.

A 2024 Deloitte report, “Generative AI: What should tax directors be thinking about?,” identified a handful of other applications where AI proves effective in optimizing tax planning, including the following:

- Automating statutory tax compliance processes while enabling more targeted risk management, and identifying opportunities for improvement across different territories.

- Streamlining due diligence during M&A by analyzing larger datasets more efficiently, leading to more accurate target valuations and better risk assessment.

- Providing real-time analysis of evolving tax regimes across multiple jurisdictions, reducing the time and cost associated with manual assessment of complex international tax structures.

- Enhancing risk review processes while helping identify potential compliance issues early.

Fraud detection and risk management

Fraud detection and prevention is another important area where AI excels, with more than 50% of accountants saying it is one of the main areas they’re leveraging in their client services.

An article in Finance & Accounting Research Journal found that, by analyzing wide amounts of financial data and documents in real-time, AI helps firms uncover suspicious patterns and complex fraud schemes that traditional methods might miss. What makes AI particularly powerful is its ability to learn and adapt; when it identifies false positives or confirms actual fraud, it adjusts its analysis to become more accurate over time.

Beyond pattern recognition, AI helps assess system vulnerabilities, detect potential threats, and automate continuous monitoring processes that would be impractical to perform manually.

This capability also extends to risk management. Advanced algorithms analyze historical data and external factors to predict potential risks, enabling firms to implement preventive measures and ensure long-term financial stability for clients.

Benefits of AI for accountants and advisory firms

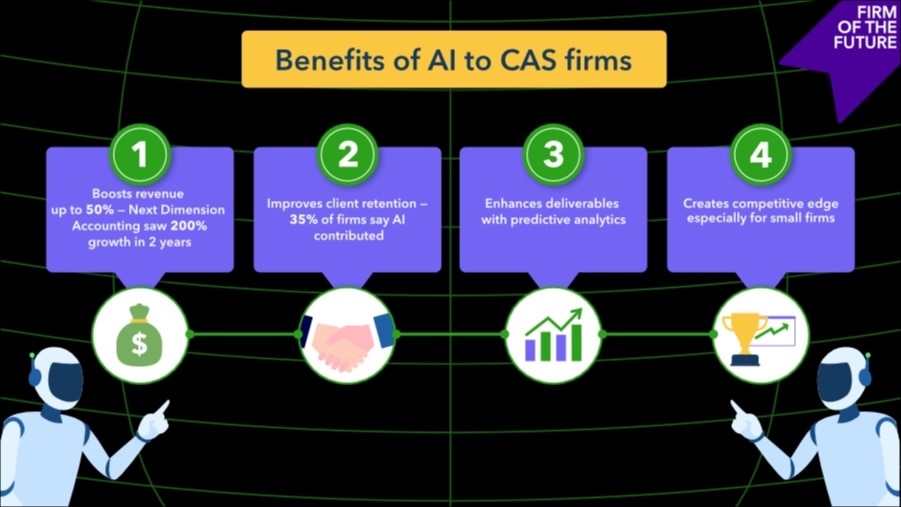

AI offers transformative benefits for CAS firms, revolutionizing traditional workflows and enabling firms to operate more efficiently. Here are some of the main advantages for firms:

- Boost revenue: By automating routine tasks and data processing, accounting firms can invest more time and resources into expanding their client advisory services, providing everything from financial planning and fractional CFO services to tax advisory, M&A guidance, succession planning, and retirement planning. Focusing on these various service offerings and business streams can increase a firm’s monthly revenue by up to 50%. The value of AI is that it also enables this investment in new services without increasing costs or headcount. For example, Australia-based Next Dimension Accounting saw a 200% increase over two years by adopting AI tools, allowing them to deliver faster, more accurate services without the need to hire additional staff.

- Enhanced deliverables: AI transforms historical financial data into actionable insights through predictive analytics, with tools that analyze past performance to forecast trends, identify potential risks, and recommend strategic actions. AI also serves as a powerful fact-checker for financial data, processing millions of data points with consistent accuracy. According to the Journal of Risk and Financial Management, AI has proven effective in everything from flagging misaligned tax rates and incorrect accounting periods, to identifying hidden transactions and potential data manipulation.

- Higher client retention: By allowing you to expand your services, get more done in a shorter amount of time, and evolve your firm’s strategic capabilities, AI has the power to keep your clients happy and engaged—with 35% of firms crediting AI with stronger client retention. It can help you stay ahead of their needs by automating regular check-ins, spotting potential issues before they become problems, and delivering insights faster. Plus, all the time you save on routine tasks means you can focus on what matters: building a strong, personal relationship with your client.

- Competitive advantage: As AI-powered tools become more common across the accounting industry, early adoption and customization will be key to getting ahead of the competition. For example, when New York-based CLA acquired UK-based tech firm Engine B—a strategic step toward building their own AI technology—CEO Jen Leary noted that this move made it clear that CLA is “becoming a force for positively disrupting the [accounting] profession” and "offering more value to clients.” In addition to helping small- and mid-sized firms remain competitive against one another, a 2024 report from the AICPA also noted that GenerativeAI (GenAI) will be a game-changer for small accounting firms looking to compete with bigger players. According to the report, AI will allow smaller firms to offer services on par with larger firms at a lower cost and with greater efficiency.

QuickBooks integrations with AI-enabled tools

Built-in QuickBooks integrations make it as frictionless as possible for accounting firms to adopt AI-powered tools in their client services. Here are a few favorites:

- Booke AI leverages AI to fix uncategorized transactions and coding errors instantly, which heavily reduces manual processing time.

- XBert runs more than 60 AI-driven checks on books daily to flag errors, potential issues, and risks.

- Octopus AI reviews a client’s books to provide clear financial analytics, personalized strategy, and advice for smarter scaling.

- Clockwork transforms transaction data into AI-powered financial models and cash flow forecasts, enabling businesses to run unlimited "what-if" scenarios with CFO-level insights.