Chances are your small business clients are scrambling to collect their contractors’ tax info in January or rushing to deliver 1099s before the IRS deadline. Now, QuickBooks® has a way to help your clients pay contractors fast with features to save you and your clients time this tax season.

New QuickBooks Online solution ideal for clients who have 1099 contractors

Pay contractors fast

Your clients can take care of payday with unlimited contractor payments and next-day direct deposit.** Plus to keep things organized, payments sync with QuickBooks Online, so their books stay up-to-date.**

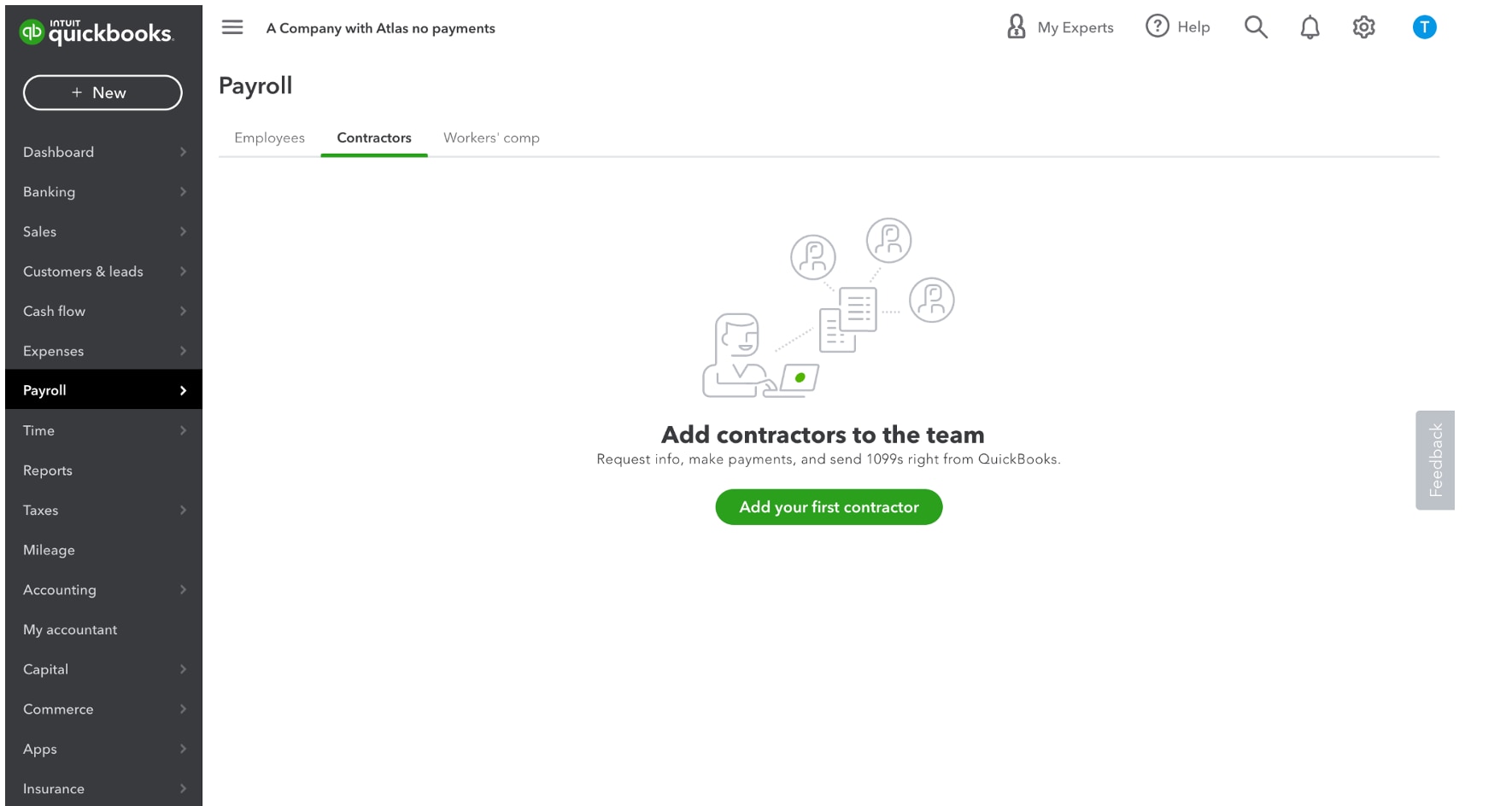

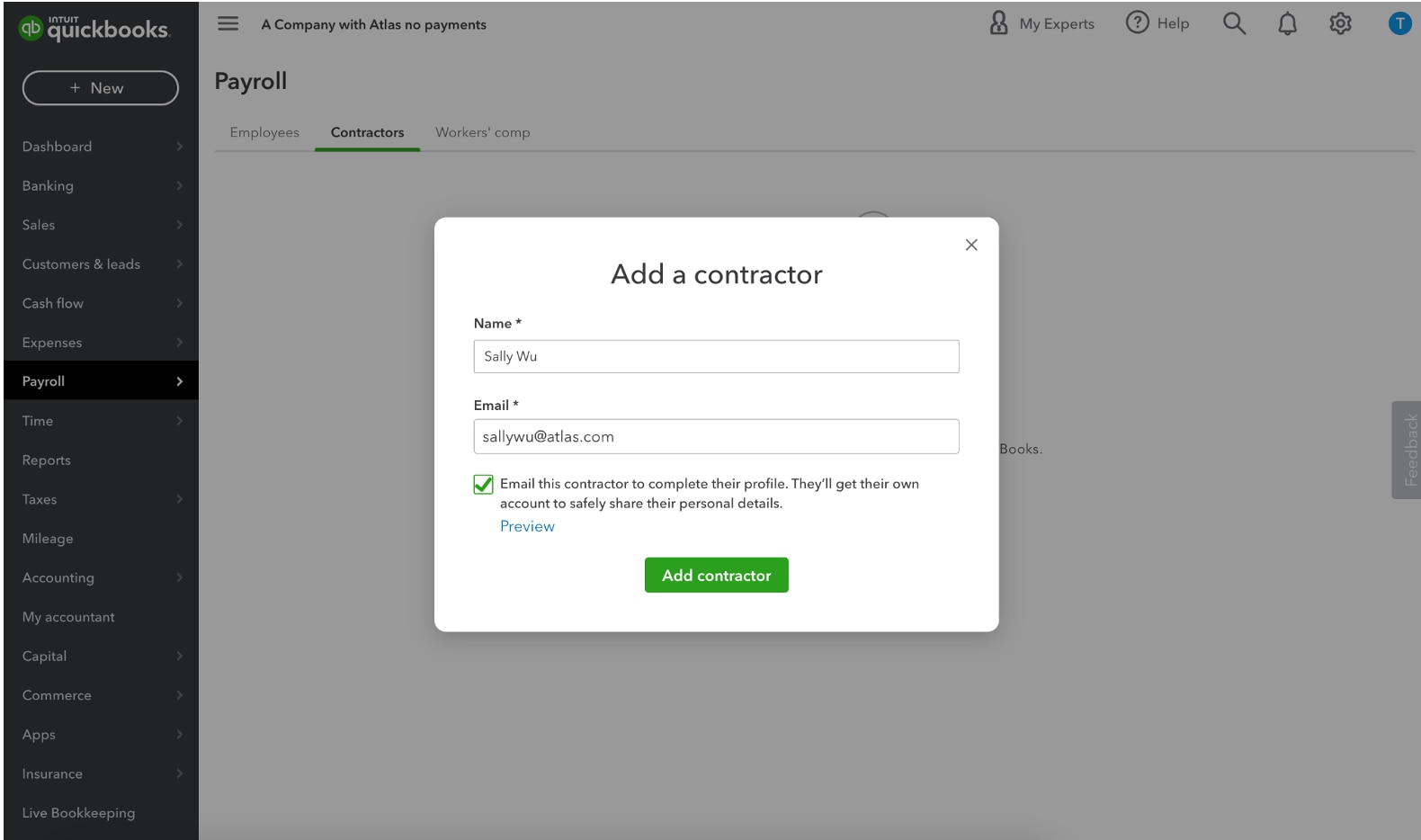

Simple self-setup

Your clients can invite their contractors to complete W-9s or provide bank deposit details online. When they invite contractors to self-setup through QuickBooks Self Employed, Intuit protects their data and adds it to their profile.

- Clients request contractors’ tax info with a click.

- Contractors receive a link to a QuickBooks Self Employed where they can complete W-9s or provide bank deposit details online.

- We’ll add the data to their contractor profile and notify the client when it’s done.

E-file unlimited 1099s

Stay tax time ready with QuickBooks Contractor Payments. Create and e-file unlimited 1099s for contractors and vendors.** E-file both 1099-NEC and 1099-MISC forms. Your 1099s are recorded and easy to categorize.

QuickBooks Contractor Payments is available for only $15/mo for up to 20 contractors and $2/mo for each additional contractor. Also, as part of ProAdvisor® Preferred Pricing for firm billed clients, there is a discount of 30% off the base fee and 15% off the per contractor fee. You can easily add Contractor Payments for your clients at the discounted rate through the billing and subscriptions page when signed into QuickBooks Online Accountant.

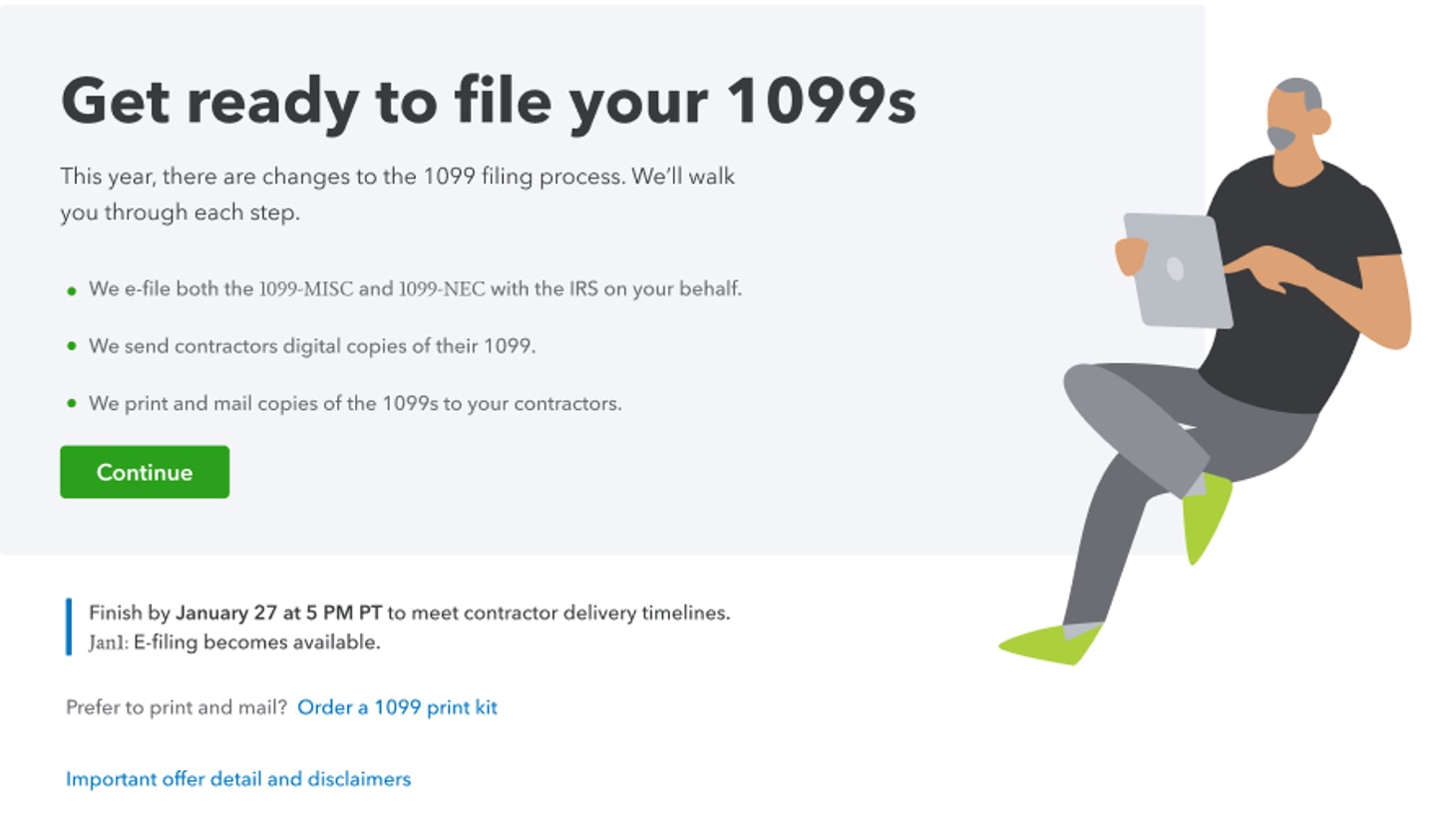

Alternatively, if your clients do not have QuickBooks Contractor Payments or QuickBooks Online Payroll that includes 1099 filing as part of their subscription, they can still file through QuickBooks Online (fees apply*), Intuit will take care of the filing and delivery.

- Clients prepare and submit their 1099s in QuickBooks.

- Intuit files them with the IRS.

- Intuit delivers copies to your contractors for no extra charge.

Help your clients maximize their time by advising them of these e-filing options!

————————————

Notes and Disclaimers

*January 2023 file rates:

- 1-3 forms at $4.99/ea

- 4-20 forms at $3.99/ea

- 21+ forms at $1.99/ea

**QuickBooks Online subscription required.** Unlimited 1099s: 1099s are e-filed only for the current filing year and for payments recorded in the system. Excludes amendment.**Next-day direct deposit: Deposits processed before 5 PM PT the day before shall arrive the next business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. May be subject to eligibility criteria. Deposit delays may occur because of third party delays, risk reviews, or issues beyond Intuit’s control.*PAPP pricing*Terms and Conditions

ProAdvisor Preferred Pricing – ProAdvisor Discount

FOR QUICKBOOKS ONLINE ACCOUNTANT CUSTOMERS WHO TAKE ADVANTAGE OF THE 30% OFF QUICKBOOKS ONLINE SIMPLE START, ESSENTIALS, PLUS, OR ADVANCED SUBSCRIPTION WITH PROADVISOR PREFERRED PRICING DISCOUNT OFFER

Eligibility: This offer is eligible to accounting firms who register or have registered for QuickBooks Online Accountant (“QBOA”) and use the ProAdvisor Discount option (“QBOA Customer”) for the QuickBooks Online (“QBO”), QuickBooks Contractor Payments or QuickBooks Online Payroll (“QBOP”), and QuickBooks Time (formerly TSheets) (collectively, “QuickBooks”) subscription fees. (The ProAdvisor Discount invoicing option means that the QBOA user agrees to pay for the QBO subscription fees (“ProAdvisor Discount”). Offer is available to new QuickBooks subscribers only.

Pricing: Eligible QBOA Customers will be entitled to the following discounts:

30% off the then-current list price of QuickBooks Online Simple Start, Essentials, Plus, or Advanced

30% off the then-current list price of QuickBooks Contractor Payments or QBOP and 15% off the then-current per employee or contractor list price

30% off the then-current list price of QuickBook Time (Formerly TSheets) and 15% off the then-current per employee list price

Discount and list price subject to change at any time at Intuit’s sole discretion. All prices are quoted without sales tax. If you add or remove services, your service fees will be adjusted accordingly.

Offer Terms: All QuickBooks subscriptions must be entered through ProAdvisor Discount and activated within 6 months of offer sign up. The discount will be terminated for any subscriptions which are not activated within the 6 month activation period. The discount is valid only for the named individual or company that registered for QuickBooks subscription and cannot be transferred to another client, individual, or company. Cannot be combined with any other Intuit offer. Offer valid for a limited time only, only in the U.S., and is non-transferable. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Billing: The QBOA Customer’s account will automatically be charged on a monthly basis. The first bill date will be on the date of enrollment unless the QBOA Customer already has other QuickBooks subscriptions through the ProAdvisor Discount, in which case the charge will be deferred to the next existing bill date at a prorated rate for all active subscriptions at the ProAdvisor Discount until the billing for subscription is transferred or the subscription is terminated. Subscriptions will be charged to your credit card through your account. Payment is due, in full, immediately upon monthly invoicing. To remove the QuickBooks subscription from ProAdvisor Discount, please click here and follow the prompts. All future monthly subscription charges will be transferred to the QuickBooks company at the then-current list price. You may remove subscriptions from ProAdvisor Discount at any time. Transfer of the billing for the subscription will become effective at the end of the monthly billing period and then the QuickBooks company will be responsible for the then-current list price of the subscription fees. You will not receive a pro-rated refund. Transfer of the billing for the subscription will not terminate the QBOA Customer’s user rights. For more information on managing user rights or deleting clients, please see here.

QuickBooks requires a persistent internet connection (a high-speed connection is recommended) and a computer with a supported Internet browser or a mobile phone with a supported operating system (see System Requirements). Network fees may apply.

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.