Here are a few things to explore.

Compare and set up health benefits for your team1

You can get health benefits for your team and have the deductions automatically added at payroll. You can compare benefit plans and choose one based on what’s important for you. Once you’ve chosen a plan, you’ll fill in a one-page application, invite your employees to enroll, and upload a few company documents. We will show you how to find those documents in the enrollment process.

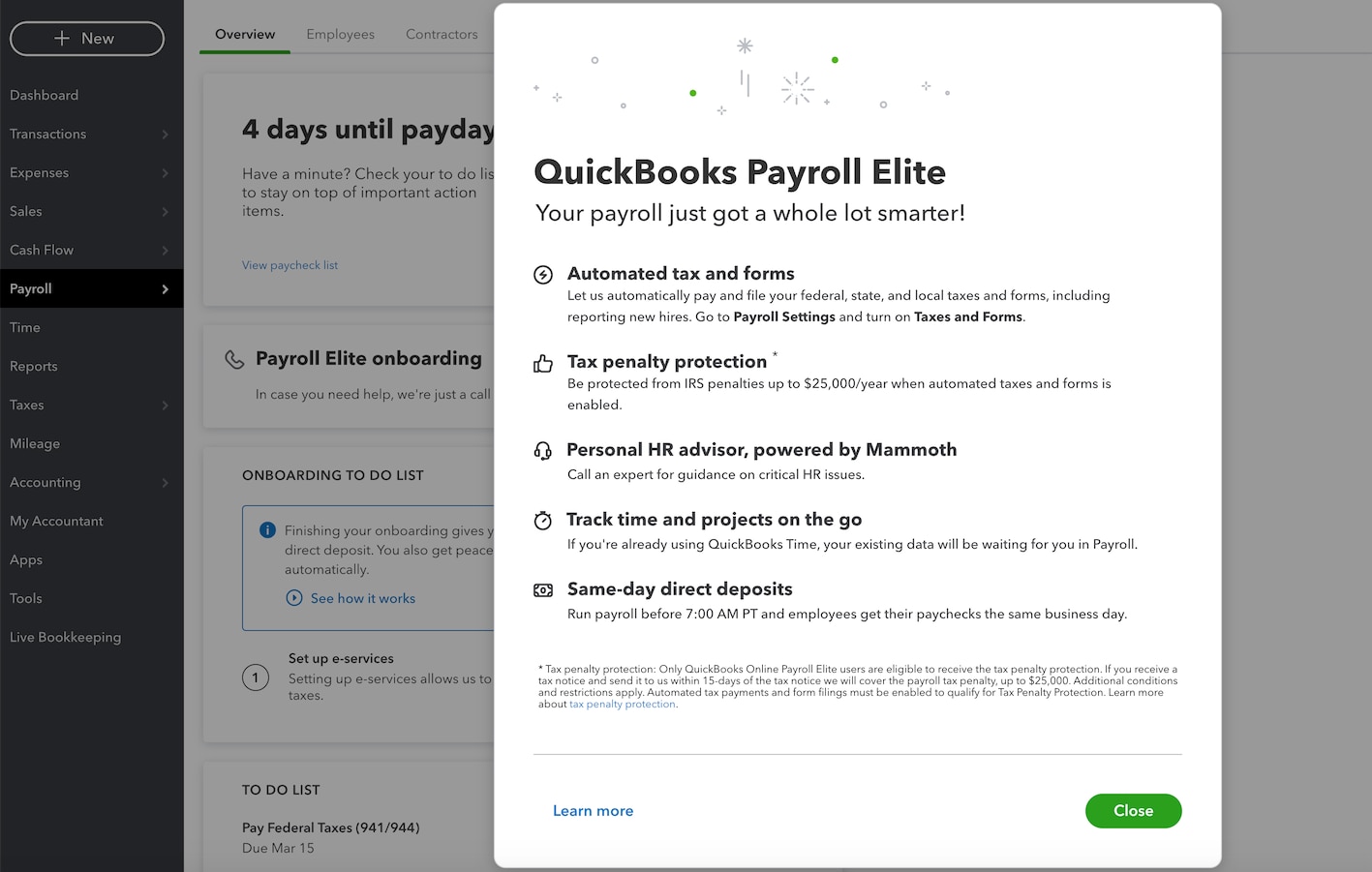

Personal HR Advisor2

Get access to a personal HR Advisor. You can consult with certified human resource advisors by phone or online, powered by Mineral. This includes receiving professional guidance on critical HR issues, as well as custom handbooks and policies created just for you.

Get your HR questions answered2

With the new QuickBooks HR support center, you’ll find guides for hiring and onboarding, termination and onboarding template letters, sample job descriptions, and information on federal and state tax laws.

Get your employees to track their own time3

Instead of manually entering time cards, your employees can clock in or out, anywhere, using their phone or computer. Geofencing alerts workers to clock in or out when entering or leaving the job site. An activity feed lets team members add and view notes, photos, and project updates from anywhere. GPS tracking makes it easy to see who’s working where, at a glance. Once it comes time to run payroll, you can review, edit, and approve employee hours right inside QuickBooks.

Tax penalty protection4

Should you receive an IRS penalty, we’ll pay all penalty fees and interest up to $25,000/year. Our Tax Resolution team will represent you. and help resolve any payroll tax or filing issues with the IRS. To qualify for Tax Penalty Protection, Automated Taxes and Forms must be enabled.

Professional payroll setup, done for you5

With QuickBooks Online Payroll Elite, you get peace of mind knowing an expert will take care of your payroll setup. Our U.S.-based specialists can answer any questions you may have, via phone, and help get your business’ payroll setup right. If you’re switching from another provider, we’ll ensure your data is transferred correctly and you’re ready to take care of business.

Expert support6

Our U.S.-based payroll support experts available via phone or chat to provide you with step-by-step help, troubleshooting assistance, tips, and resources. We also provide callback support, which means you’ll get answers on your time without having to wait on hold.

Set up your Auto Payroll7

If your firm only has salaried employees on direct deposit, your setup is complete, you have no holds on the account, and you have run your first payroll, you can run payroll automatically without you even logging in. Once you set up your Auto Payroll, you’ll be able to approve and, if needed, update your paychecks before they’re sent. If you need to pay an employee with a paper check or with an off-schedule payroll, you can pause Auto Payroll for a pay period and pay your employee manually. Auto Payroll will start again with your next pay run.

Reminder: Your clients who are directly billed by Intuit® (bill my client) may upgrade, manage, or cancel their subscription at any time by visiting Account and Settings and selecting Billing & Subscriptions.

You may upgrade, manage or cancel subscriptions under the Wholesale Billing (bill my firm) option at any time by visiting Your Company and selecting Your Account. You can see more information on how to successfully transfer the billing to your client.

To learn more about Auto Payroll and these other benefits, visit our dedicated QuickBooks Online Payroll page.