Q: Why does the employee direct deposit fee impact some Desktop Payroll Enhanced and not others?

A: QuickBooks Desktop Payroll has two types of pricing plans:

- “Legacy” plans that Intuit stopped selling many years ago that charge the base subscription fee and direct deposit fee to W-2 employees and contractors. There is no additional per employee fee charge. This type of payroll is impacted by the employee direct deposit fee change.

- “Non-legacy” pricing plans that charge a base subscription fee and monthly per employee fee, with no additional charge for direct deposit for W-2 employees. This type of payroll pricing plan is not impacted by the employee direct deposit fee change.

Q: How are accountants impacted by the direct deposit price increase?

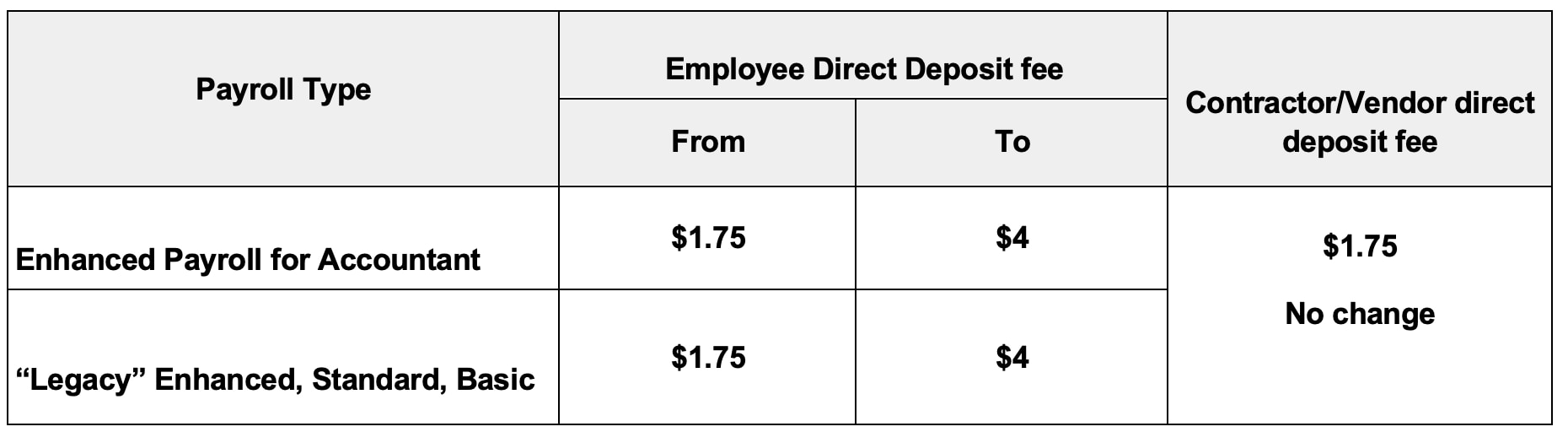

A: The employee direct deposit fee increase impacts QuickBooks Enhanced Payroll for Accountants (EP4A). Payroll clients of EP4A are billed directly for the direct deposit fees and will see the increase starting Jan. 8, 2024. Intuit will send an email notice to the clients impacted by the new price on or before Dec. 9, 2023.

Q: Is QuickBooks Enterprise impacted by the employee direct deposit price increase?

A: No, QuickBooks Enterprise products inclusive of Payroll are not impacted by the employee direct deposit fee increase.

Q. What other payroll options are available for accounting professionals?

A. The ProAdvisor program offers preferred pricing on QuickBooks Online Payroll. When you pay for your clients’ payroll subscriptions, you can take advantage of the exclusive ongoing discount and receive one consolidated monthly bill. For clients who prefer to pay for their subscriptions themselves, you can pass on an exclusive discount available only through you. See details and pricing here.

Q. What payroll options are available for my clients?

A. Clients have several Payroll options:

- Switch to QuickBooks Online Payroll for anywhere anytime access, and automated payroll tax filing and payments. You can also offer HR benefits, including 401(k) plans, healthcare, and workers comp through QuickBooks.

- Upgrade to QuickBooks Enterprise Gold or Platinum, which includes Enhanced Payroll, for higher efficiency, enhanced security, deeper insights, and more automation.

- For more complex businesses, upgrade to QuickBooks Enterprise Diamond, which includes Assisted Payroll. Add or customize functionality as the company grows.

- Switch to Desktop Enhanced Payroll, which has the same functionality as the “legacy” Desktop Enhanced Payroll. This plan has a $6 monthly per employee fee, but direct deposit service is included at no additional charge for W-2 employees.

Q. How do other Desktop Payroll price increases overlap with the employee direct deposit price increase?

A. Various payroll fees are billed at different times, so clients may see pricing changes at different times:

- Monthly or annual subscription fee: The majority of Desktop Payroll users are on annual subscriptions; the subscription fee change takes effect on their annual renewal date. Customers impacted by the price increase receive a 30-day notice prior to the new price. For “legacy” DIY Payroll users, the base fee change will occur between 12/1/2023 and 11/30/2024.

- Employee direct deposit fee: This fee is charged at the time of usage (pay as you go), and the fee change takes effect on 1/8/2024 for all payroll clients impacted.