Which taxes are included in the one-time withdrawal for existing customers? What about quarterly taxes from the third quarter or monthly taxes from September?

For customers getting the update on Oct. 1, we’ll make a one-time withdrawal for any unpaid federal unemployment (FUTA) taxes to date. We’ll send your clients an email and notification reminders beforehand. Other taxes for periods ending prior to Oct. 1 will be withdrawn on their deadlines as they previously had been.

For customers getting the update on Jan. 1, 2025, no one-time withdrawal will occur, as there are no unpaid FUTA taxes at the start of the tax year. Other taxes for periods ending prior to Jan. 1 will be withdrawn on their deadlines as they previously had been.

Where can my clients check if they’ve received the update?

Clients receiving the update on Oct. 1 started receiving notifications on July 1 via email and in-product message. Once the update is live, you and your client will be able to view withdrawal amounts in the Payroll tax center as well as the preview when running payroll.

Clients receiving the update on Jan. 1, 2025 were notified on Oct. 1.

How can my Auto Payroll clients who are receiving the update provide consent?

Clients who were notified about the update can log into QuickBooks Online Payroll as the primary admin, navigate to the Payroll overview, and click “Keep using auto taxes.”

How many tax withdrawals will there be on pay day?

If Auto Tax is on, there will be one withdrawal for all tax jurisdictions at each pay run. If Auto Tax is off, it’s up to your client to pay and file for each tax agency by the deadline.

Will my clients still be able to use automated taxes the current way, where taxes are withdrawn on the tax deadline instead of pay day?

No, we are rolling this update to the feature out to all customers who use automated taxes. We want to provide more consistency in dates when it comes to withdrawing funds for taxes and the ability to set aside money on an ongoing basis, versus having one large lump sum taken out at tax time. This can help decrease the possibility of non-sufficient funds notices which can help customers avoid tax notices. In addition, we're maintaining the ability for customers to file payroll taxes DIY by turning Auto Tax off.

How can my clients view/change their automated taxes setting?

To view, and change, their payroll taxes and form filing status, go to Settings ⚙, then select Payroll settings, and in the Taxes and forms section, select Edit ✎. Here’s where they can see how their payroll taxes and forms are handled. Your clients have the flexibility to choose how they want their payroll taxes and filings handled and can change it at any time. Changes to automated tax status will take effect at the start of the following month. Learn more

My client has Automated taxes and forms turned On, but how do I know if my payroll taxes are set up?

On the Payroll Overview page, the Automated taxes widget will let your client know if there are additional actions they need to take. If there are, click on “Finish up” to complete the necessary steps. Learn more

Why aren’t automated taxes being withdrawn for all the tax agencies my client has employees in?

On the Payroll Overview page, the Automated taxes widget will let your client know if there are any tax agencies that need additional information to have taxes withdrawn automatically. Learn more

How will it work if my client has some employees in the listed states, and other employees in states that aren’t listed?

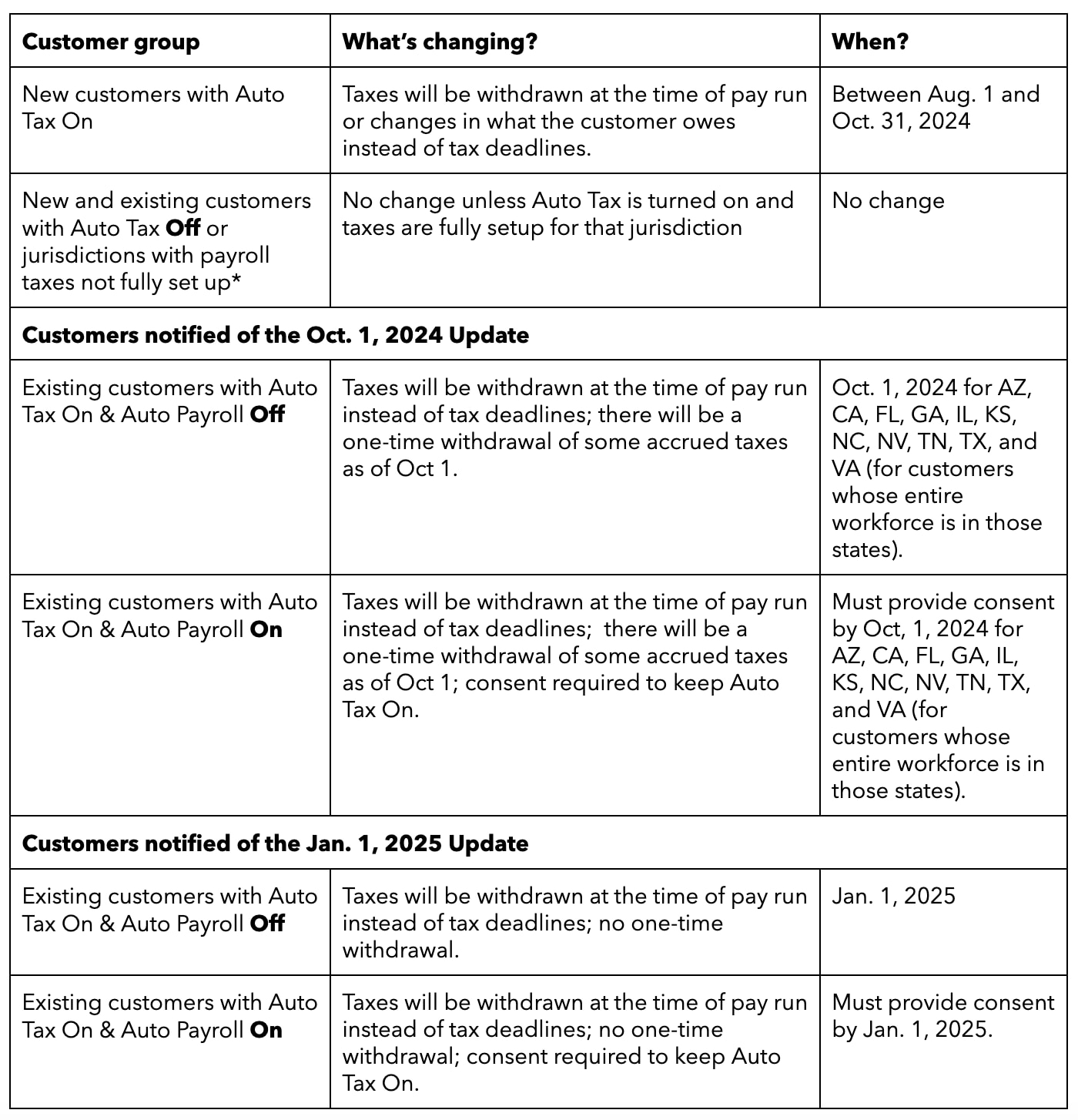

Clients receiving the update on Oct. 1 were notified starting on July 1 via email and in-product message. Unless your client’s entire workforce is in one of the listed states, they will receive the update on Jan 1, 2025. A small subset of customers who later hired employees in states with local taxes will also receive the update on Jan 1, 2025. Once the update is live, you and your client will be able to view withdrawal amounts in the Payroll tax center as well as the preview when running payroll.

What happens if my client hires an employee in a new state?

They will need to complete tax setup for that state to begin having payroll taxes withdrawn automatically. After they receive the update, taxes will begin being withdrawn at the time of pay run or changes to tax liabilities for all tax agencies that have been set up. They will also receive a one-time withdrawal for any unpaid taxes to date for each new jurisdiction set up. Learn more

Can my clients get this update to automated taxes early?

At this time, we cannot accommodate requests for an early update of the feature.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Automated payroll tax payments and filings: Automated payroll tax payments and filing available for state and federal taxes. Enrollment in e-services is required. Automated payroll tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.