We’re investing in the future of our flagship QuickBooks® Online Payroll service by streamlining our product offerings and transitioning you and your clients from Intuit® Online Payroll and Intuit Full Service Payroll to stand-alone QuickBooks Online Payroll. This transition will allow us to sharpen our focus on delivering to you what we believe to be a better online payroll service going forward – more modern, with more features, more automation, more time savings and better ongoing development support. More about QuickBooks Online Payroll

Timeline of transition

Through May 2022, rest assured you can continue to run payroll and 1099s for yourself and your clients on Intuit Online Payroll or Intuit Full Service Payroll as you do today. We know many of you are excited to make this transition, so we plan to open up an early, voluntary transition period from November 2021 to May 2022. Starting in June 2022, if you have not transitioned your payroll clients, we will make the transition for you. Well ahead of time, we’ll be in touch with details on timing for this transition. In either case, each transition over to a standalone QuickBooks Online Payroll service will be seamless, with no work required by you or your clients. The interface you use will change from Intuit Online Payroll or Intuit Full Service Payroll, to QuickBooks Online Payroll, but all your payroll data stays safely where it is, including reports, notes and alerts.*

When voluntary transition is open to you and your clients, you’ll receive instructions via in product messaging and email. You will be able to control the timing of your and your clients’ transitions and when you transition, we will do all the work for you. With the transition, you and your clients will be offered the most competitive pricing for QuickBooks Online Payroll. If you have questions about your specific situation you can check our FAQs. See FAQs. We also have resources to help you manage this move with your clients. See transition resources

*For any of your clients using QuickBooks Online, you will still be able to export data into QuickBooks Online from QuickBooks Online Payroll stand-alone. Export into QuickBooks Online or Desktop from Core, Premium, or Elite Standalone Payroll

Transition experience

Your firm’s transition experience

- For your firm, you’ll have QuickBooks Online Accountant for free so you can easily manage your clients’ QuickBooks Online Payroll accounts. Learn about QuickBooks Online Accountant

- You’ll also have QuickBooks Online Payroll Elite for free for your firm’s payroll.* If you’re already using Intuit Online Payroll for your firm or Intuit Full Service Payroll, we’ll move you over to QuickBooks Online Payroll Elite.

- And if you're interested in getting training and certification in QuickBooks Online Payroll or other QuickBooks offerings, check out our up-to-date trainings and training resources.

Your payroll clients’ experience

- For your payroll clients, you will be able to select the service that you feel is best for them between Core, Premium, or Elite. If you prefer not to take advantage of the voluntary transition period, we’ll transition your clients to Core from Intuit Online Payroll or Premium from Intuit Full Service Payroll, though you’ll still be able to change to Core, Premium or Elite after the transition.

- Features in QuickBooks Online Payroll Core:

- Full Service Payroll with automated taxes and forms (with ON/OFF option).**

- Next-day direct deposit.**

- Auto Payroll for employees paid by direct deposit or paper check.**

- Integrated Health benefits for their team, powered by Allstate Health Solutions.**

- Integrated 401(k) plans powered by Guideline.**

Learn more about all features available in Core, Premium, and Elite here.

Your 1099 experience

- For your payroll clients, you will be able to manage their 1099s within QuickBooks Online Payroll at no additional cost as part of the standalone QuickBooks Online Payroll subscription once they are transitioned.

- For any of your clients without a QuickBooks Online Payroll subscription, Intuit Online Payroll for 1099 is being replaced by QuickBooks Contractor Payments. For $15/mo (for up to 20 contractors), your clients can do unlimited next-day direct deposits, collect W9 and file unlimited 1099 for their contractors. The contractors will get a paper copy of the 1099 mailed to their address, and will be able to download their 1099 electronically. Learn more

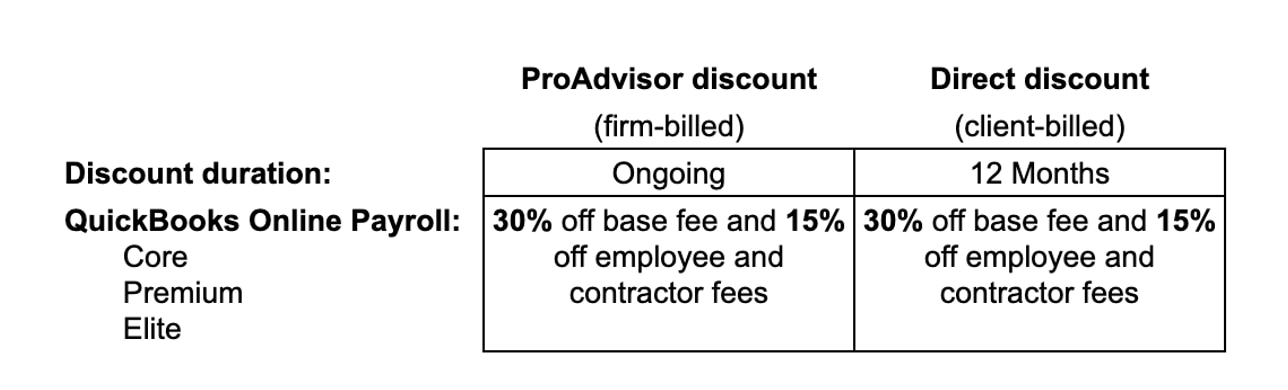

Pricing after transition

You and your clients will move to Intuit’s ProAdvisor® Preferred Pricing.* ProAdvisor Preferred Pricing offers best-in-class discounts to our ProAdvisors. You will always have our best pricing on QuickBooks Online Payroll for you and your clients. And, should you choose to take advantage of other products, like QuickBooks Online and QuickBooks Time (including the QB Workforce mobile app). ProAdvisor Preferred Pricing offers similar discounts for them. ProAdvisor Preferred Pricing details