Thank you for trusting QuickBooks® with your payroll needs. We appreciate your business and are committed to ensuring your success, as we transition you and your clients to our enhanced suite of payroll products. This article will serve as a portal to keep you up to speed on timing and what to expect, as you and your clients transition over the next few months. We encourage you to check back regularly for the latest updates!

Here’s what to expect:

Accounting and bookkeeping firms

- If your firm currently uses QuickBooks Full Service Payroll, your transition will occur on, or after, Oct. 1, 2020. Your account will be upgraded to QuickBooks Online Payroll Elite. Automated taxes and forms will be set to ON. This can be changed under settings.

- If your firm currently uses QuickBooks Online Enhanced Payroll, your transition will occur on, or after, Oct. 1, 2020. Your account will be upgraded to QuickBooks Online Payroll Elite. Automated taxes and forms will be set to OFF. This can be changed under settings.

- Exception: If your firm also uses TSheets, your transition will occur on, or after, March 1, 2021, regardless of which payroll product you currently use. We’ll provide additional information closer to that time.

Your firm will have access to QuickBooks Online Payroll Elite, free of charge, through QuickBooks Online Accountant! Payroll Elite includes the ability to track time and projects on the go, 24/7 expert product support, and access to an HR personal advisor powered by Mammoth. If you have been paying and filing taxes on your own, you can continue to do that, or we can do that for you for free. If you ask us to pay and file for you, we’ll review your account and then turn on Tax penalty protection.

Clients

Clients using QuickBooks Full Service Payroll

- Clients currently using full service payroll will transition on, or after, Nov. 1, 2020. This includes both wholesale clients and clients billed by Intuit® (bill my client).

- All of your clients will receive notice of the upcoming transition via email, approximately 30 days in advance of their “on or after” transition date. The notices sent to wholesale clients will not include any information on pricing, but also include the product name change and the new features they will have access to.

- Clients currently using full service payroll will have automated taxes and forms set to ON after the transition. This can be changed to OFF under settings.

Clients using QuickBooks Online Enhanced Payroll

- Clients currently using Enhanced payroll will transition on, or after, Nov. 1, 2020. This includes both wholesale clients and clients billed by Intuit (bill my client).

- All of your clients will receive notice of the upcoming transition via email approximately 30 days in advance of their “on or after” transition date. The notices sent to wholesale clients will not include any information on pricing, but also include the product name change and the new features they will have access to.

- Clients currently using Enhanced payroll will have automated taxes and forms set to OFF after the transition. This can be changed to ON under settings.

NOTE: There are some instances where a client may not transition in November 2020. For example, if they also use TSheets, their transition will not occur until on, or after, March 1, 2021. There may also be some instances where a client does not transition as scheduled, for example, if they are logged into the product at the time of the transition. We will ensure they transition with a subsequent wave.

Transition details for clients

Clients using QuickBooks Full Service Payroll

Product name change:

- QuickBooks Full Service Payroll will become QuickBooks Online Payroll Premium

New features available in Premium:

More information about these features in disclaimers section below.

- Track time on the go with Premium time tracking by TSheets

- Access to an HR support center, powered by Mammoth

- Auto Payroll for clients with all salaried employees on direct deposit

New price structure:

- Base Fee: $75/month

- Wholesale base fee : $37.50/month – 50% off for lifetime of subscription

- Employee fee: $8/month per employee*

- Contractor fee: $8/month per contractor paid via direct deposit*

*If a client billed by Intuit (bill my client) has more than 10 employees or contractors, they will transition to an offer with discounted per employee/contractor pricing for 12 months from the date of their transition to QuickBooks Online Payroll Premium. Employees/Contractors 1-10 will be $8 per month, and 11+ will be $4 per month. After the first 12 months, the price will increase to the then-current list price for employees and contractors. All wholesale clients will transition to an offer with the above discount for 12 months from the date of their transition. After 12 months, the price will increase to the then-current list price for employees and contractors.

Clients using QuickBooks Online Enhanced Payroll

Product name change:

- QuickBooks Online Enhanced Payroll will become QuickBooks Online Payroll Core

New features available in Core:

More information about these features in the disclaimers section below.

- Automated taxes and forms (with ON/OFF option)

- Auto Payroll for clients with all salaried employees on direct deposit

New price structure:

- Base Fee: $45/month

- Wholesale base fee: $22.50/month – 50% off for lifetime of subscription

- Employee fee: $4/month per employee*

- Contractor fee: $4/month per contractor paid via direct deposit*

*If a client billed by Intuit (bill my client) has more than 10 employees or contractors, they will transition to an offer with discounted per employee/contractor pricing for 12 months from the date of their transition to QuickBooks Online Payroll Premium. Employees/Contractors 1-10 will be $4 per month, and 11+ will be $2.50 per month. After the first 12 months, the price will increase to the then-current list price for employees and contractors. All wholesale clients will transition to an offer with the above discount for 12 months from the date of their transition. After 12 months, the price will increase to the then-current list price for employees and contractors.

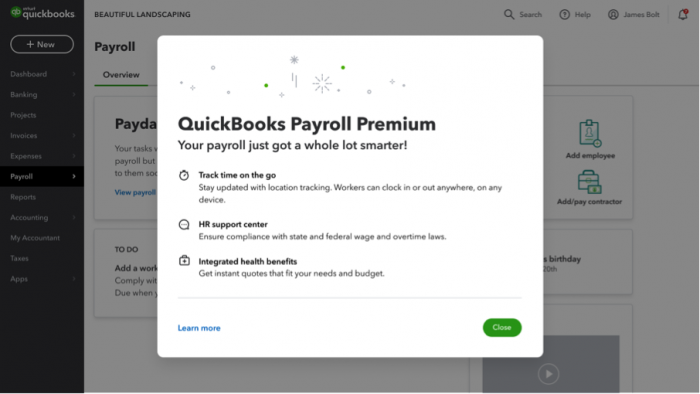

Transition experience

There’s nothing you or your clients need to do – we’ll monitor the transition closely to ensure there are no interruptions to your business or your clients. When you log in and click on the Payroll tab for the first time after the transition, you and your clients will see a welcome message similar to the image below. At that time, you can choose to learn more, which will open up a new page with additional feature information, or you can dismiss the message. Regardless, you and your clients will have access to the additional information via the Notification bell for 30 days.