2. Invest in the relationship

Clients don’t want a transactional relationship where they are just a virtual file number. Your clients want to know they matter. If clients were to rate your firm from one to five for being client-centered, what grade would your firm receive?

Client advisory services go the extra mile. CAS and value pricing are a perfect match. According to a Deloitte study, client-centered firms are 60 percent more profitable than transactional firms.

Clients trust their advisors to have their best interests top of mind.

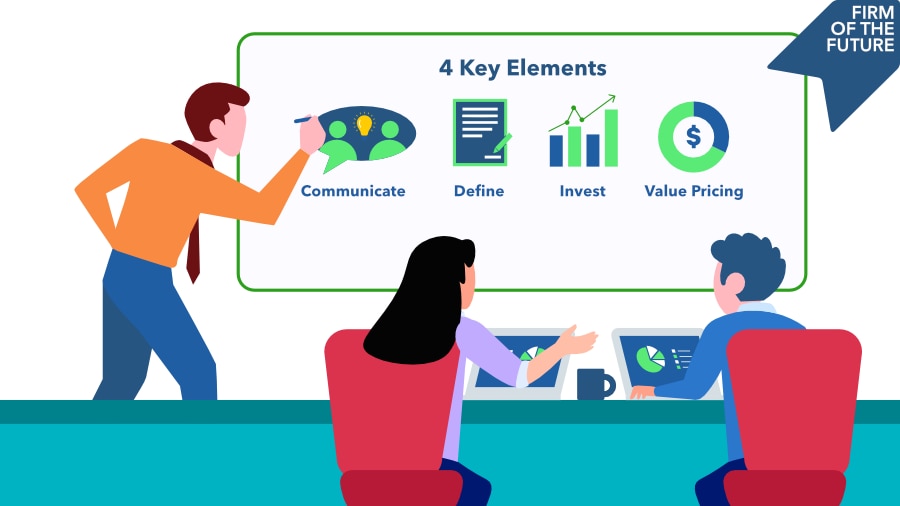

There are four ways to invest in the client relationship:

- Priorities. Determine what your client wants to achieve and why that’s important.

- Dialogue. People crave to be seen and heard. Pay attention to what your clients say. An advanced move is to read body language—whether the meeting’s in-person or virtual.

- Guidance. Provide your clients with insights that lead to informed decisions.

- Perspective. Don’t just agree with clients to avoid conflict. They appreciate honesty—offer candid input about the pros and cons.

3. Define the scope of services

The subscription model is ideal for value pricing advisory services. It’s similar to the software solutions your firm may use. Software products typically offer three package options, and each option bundles a specific scope of services. You then choose the package that best fits your needs.

Now consider the various needs of your clients. Smaller businesses require the essentials; a larger business has more complexity.

Think about what matters to your clients.

Questions to ask include:

- What problems do you solve for your clients?

- How will advisory meetings impact their business?

- Why choose you? What do you offer that your competitors don’t?

- How do the multiple services you provide work together for optimal results?

Like most software solutions, you want to offer three packages: silver, gold, and diamond. Research about the psychology of choice proves that three options are best. Essentially, people make decisions by comparing different options. Differentiate your packages by the level of financial insights and frequency of advisory sessions.

Clients will choose a package based on deliverables and results. Educate your clients about how advisory services will impact their business. This is more valuable than the task and tools.

4. Value price advisory services

If you’re like many accountants, you’re intrigued by value pricing, but not sure where to start. The path to separating your fees from time continuously improves—similar to learning to ride a bicycle. Since you’re a bit unsteady at first, you use training wheels. Once you gain balance and confidence, you remove the training wheels, and start going faster and further with confidence.

I like to use the Good-Better-Best Pricing model to get accountants started with value pricing their services:

Good rate. New clients inquire about your services. Determine the fixed monthly fee you would normally charge by calculating time by your firm’s hourly rate. Let’s say the original rate would be $100. Now multiply that fixed fee by 1.5. Your proposal will be the new “good” rate of $150. Enroll three new clients into the new good rate. As clients enroll in your new good rate, you start to realize that not all clients are price-sensitive.

Better rate. After enrolling three clients into your new good rate, move to tier 2. This will be your better rate. Once again with new potential clients, determine the original fixed fee you would charge. Let’s continue to use the example of $100 as the original fixed fee. Now multiply that fixed fee by 2. Your new better rate for that client will be $200.

As you enroll new clients into your firm at the new better rate, you engage a higher quality client. Your ability to educate clients about the value of your firm’s services is also improving. By the way, you now earn double what you originally charged without having to work additional hours.

Best rate. After you enroll three new clients into your new better rate, move to tier 3: best rate. Similar to the previous tiers, calculate the fee you would have originally charged a new client for your services. Then multiply that by 3. The proposal states the fee is $300 instead of the original $100.

Doing this requires courage, not confidence. As a result, you now earn three times more than your original fee. The client experience improves, since you don’t need as many clients to meet your revenue needs.

As you move up the tiers, you engage a higher quality client and work fewer hours. As a result, the freed time can be used for business development, expanding your advisory services, or additional personal time.

Value price your advisory services

While traditional price strategies prioritize time and costs, value pricing considers the client, first. Increasing a client’s revenues by $140,000 has far greater value than the time spent meeting to outline the plan. Clients hire your firm for your expertise to deliver results, not the time and tech required. Position your services as an investment by focusing on the results your firm is able to deliver.

Value pricing your firm’s advisory services skyrockets your profit margin. Separating your fees from time rewards efficiency and highlights your expertise. With the Good, Better, and Best Pricing model, your firm now earns two to three times more than if you continued to price for time and costs. Working closely with your client for continuous growth and increased value results in a win-win.