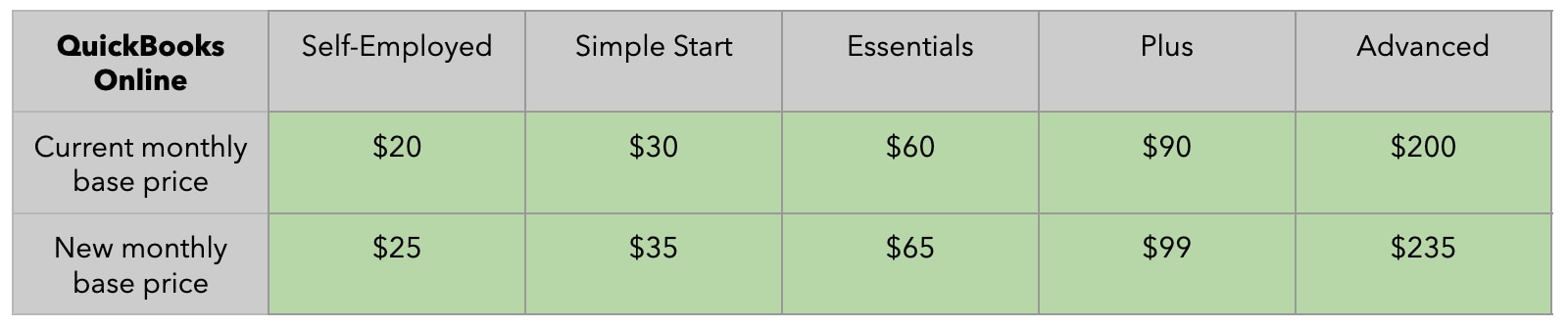

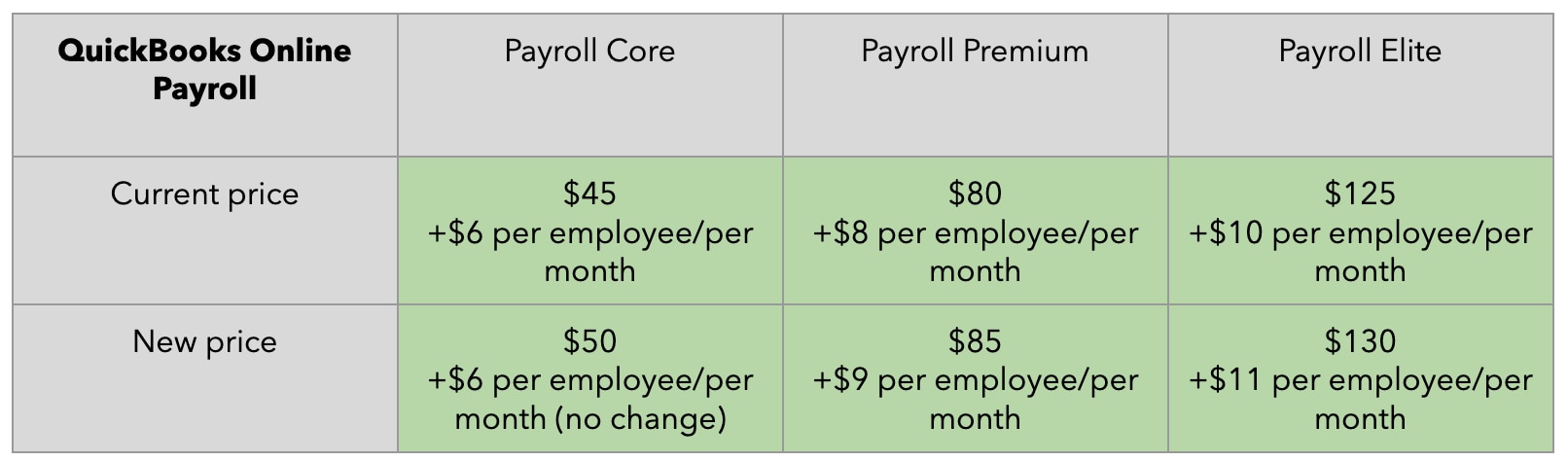

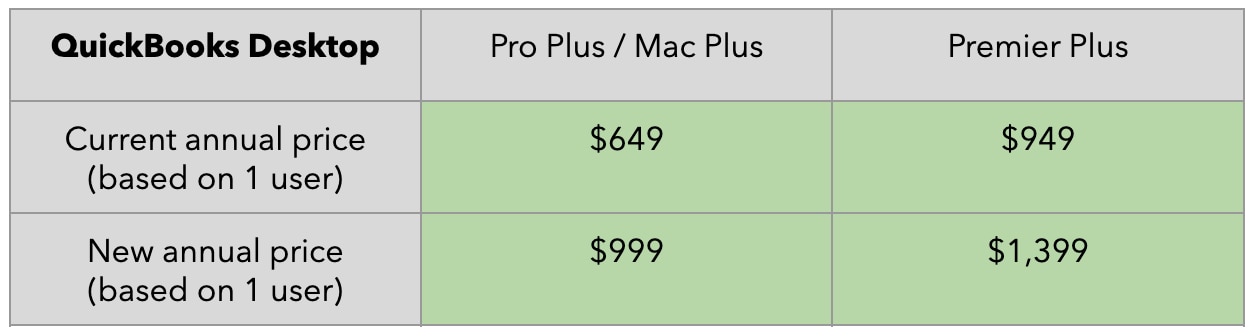

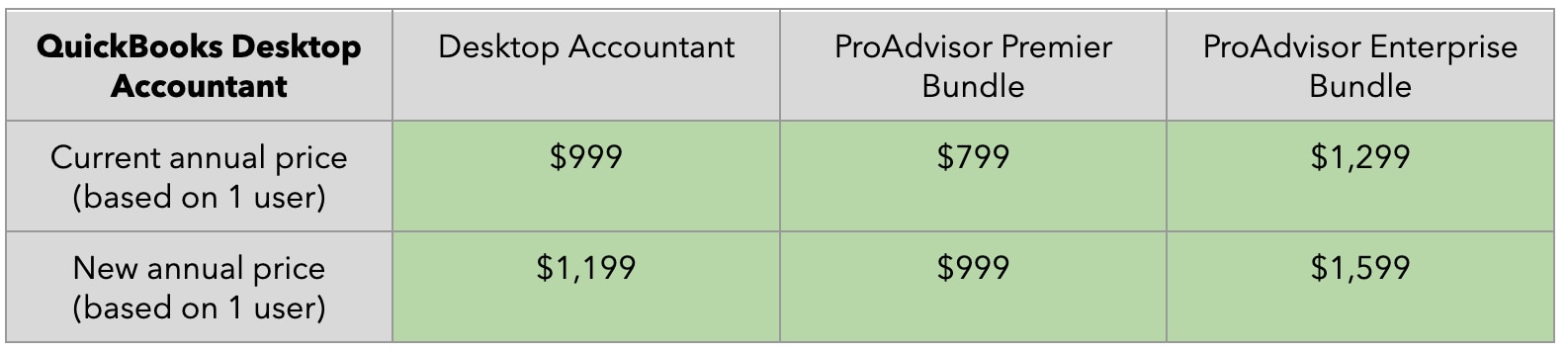

On June 10, 2024, you received an email announcing upcoming pricing changes for QuickBooks products and services. Below are answers to common questions about these changes.

Q: Why are you increasing prices?

A: Our goal is to deliver an online, integrated platform that helps you and each of your clients succeed—at every stage of your and your clients’ business journeys. The QuickBooks platform is designed to save you time and fuel your growth by streamlining workflows and giving you access to data so you can advise your clients and help them make more-informed business decisions. We are supercharging QuickBooks with the power of AI, through Intuit Assist and the automation of tasks, to help save you and your clients time and enable businesses to get paid faster.

We have also made improvements across core accounting workflows and within within QuickBooks Online Accountant. By adding document management capabilities and accountant-only views, our goal is to make it easier for you to view client transactions and app use. We also have several new and improved payroll-related features, such as a deeper integration between between QuickBooks Payroll and QuickBooks Time, advanced payroll cost allocation, bulk pay item management, an HR hub for employee record management, and benefits, including a new healthcare partnership healthcare partnership with Allstate Health Solutions.(Services sold separately. Additional terms and conditions apply).

See more details about these and other key enhancements we’ve made to the QuickBooks platform.