As we get ready to close out 2024, it’s a great time to walk through an end-of-year checklist with your clients. It’s also the season when some clients may look to you for more guidance, such as advisory services. Whatever the case may be, your steady, professional help is just what they need. Be sure to read about all the new updates that can help them even more.

QuickBooks Online new features and updates—December 2024

Share these QuickBooks updates with your associates and clients of the latest innovations relevant to business owners and admins.

Table of contents

Table of contents

Stay In the Know

Learn about the most exciting innovations. Visit the Hub to watch weekly videos or join us for a live webinar on Thursday, December 19 at 11 AM PT.

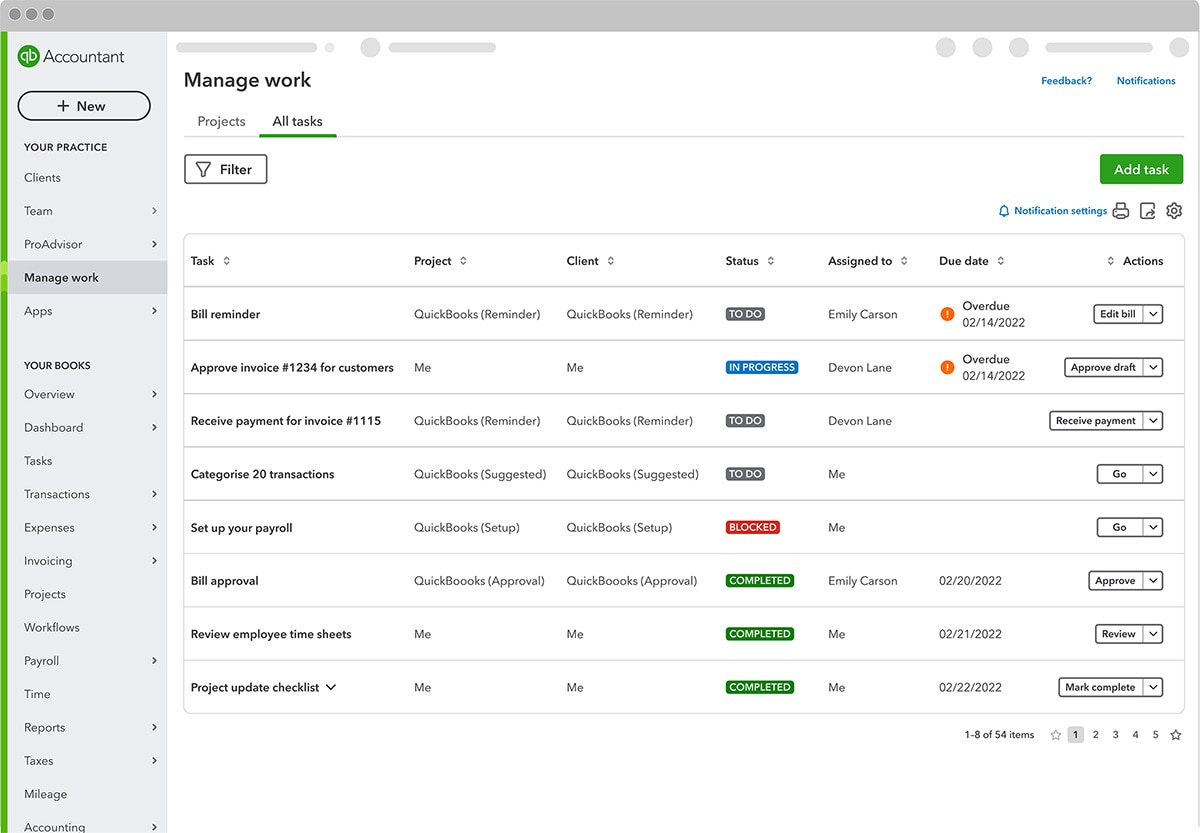

Continuing updates to Project and Task functionality in QuickBooks Online Accountant

In a nutshell: Work the way you want with more capabilities in the Work tab.

You may have already seen new additions to the Work tab in QuickBooks Online Accountant. We are partnering with accountants to add key updates over the next few months to help you and your team organize tasks, projects, and deadlines. To begin with, you’ll see:

- More options to sort and filter, so you can quickly find important projects and tasks.

- A refreshed spreadsheet layout to help streamline task and project setup.

- Added functionality that lets you manage more aspects of a project in one place, and create standalone tasks unrelated to projects.

To try these updates, go to QuickBooks Online Accountant and select Work. Learn more

Note: If you’re already using the Work tab, you’ll see the option to switch between the old and new experience for the next 3 months. This can help smooth the transition for your firm.

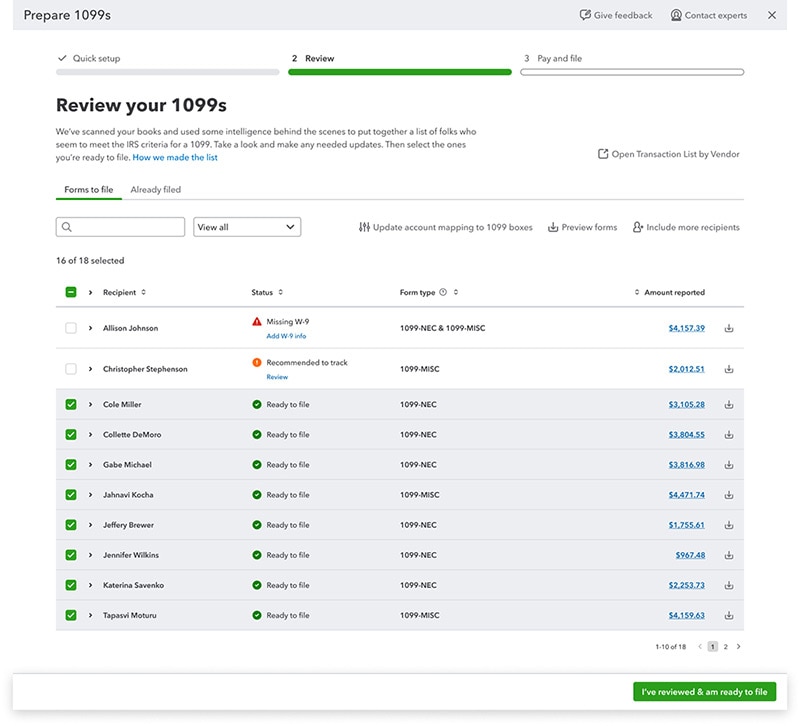

Combined Federal/State Filing and simplifying 1099s

In a nutshell: Recent updates simplify managing 1099s.

For the upcoming 1099 season, your clients might notice two key changes:

- QuickBooks now supports Combined Federal/State Filing, which eliminates the need to file separate 1099s to participating states. With this update, you and your clients can handle more year-end compliance at once.

- QuickBooks now has an Automated 1099 solution, in addition to the standard version. This automated option has a W-9 management module that uses QuickBooks transactions and vendor info to produce a list of contractors and/or vendors that may require a 1099 Form. QuickBooks Automated 1099 will also suggest which payments to include on the form and which box to map them to, auto-populating the 1099 forms for you. From here, all you have to do is review and edit them as needed before filing.

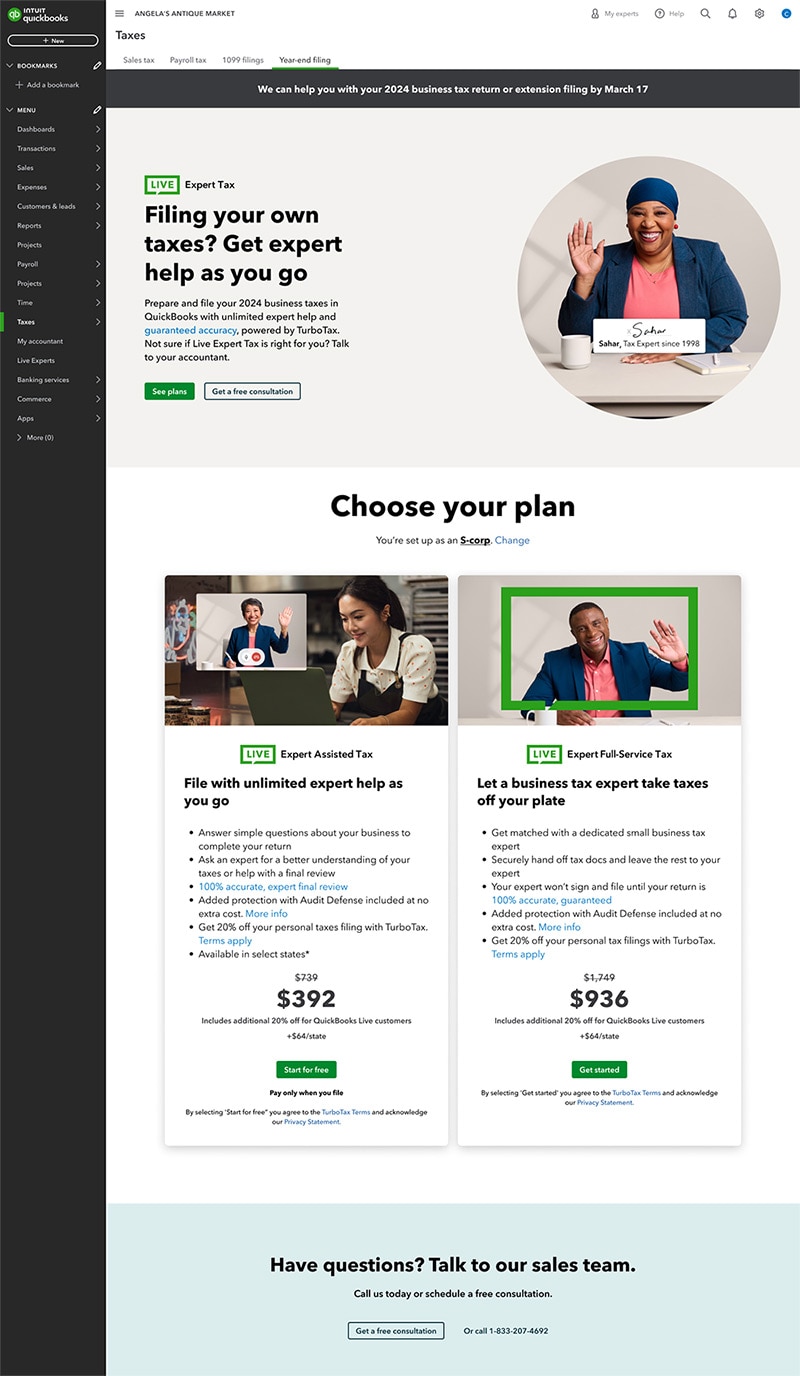

Business tax support for accountant-attached QuickBooks Online users

In a nutshell: Clients who file their own tax returns may notice new info about QuickBooks Live Business Tax.

In addition to informing business owners without accountants about QuickBooks Live Tax, we’ve also made it easier for accountant-attached self-filers to learn about the filing support QuickBooks Live Business Tax can provide.

Previously, the information available to business owners was a set of questions and answers. Now, they’ll see info about expert tax help in their Year-end filing tab (see below). QuickBooks Live Tax is designed to provide small businesses a seamless books-to-tax experience inside QuickBooks, including preparing and filing taxes.

We included this update because transparency is important to us. At QuickBooks, we acknowledge and respect your relationships with your clients, and one goal we uphold through our work is to help an accountant’s client engagements thrive.

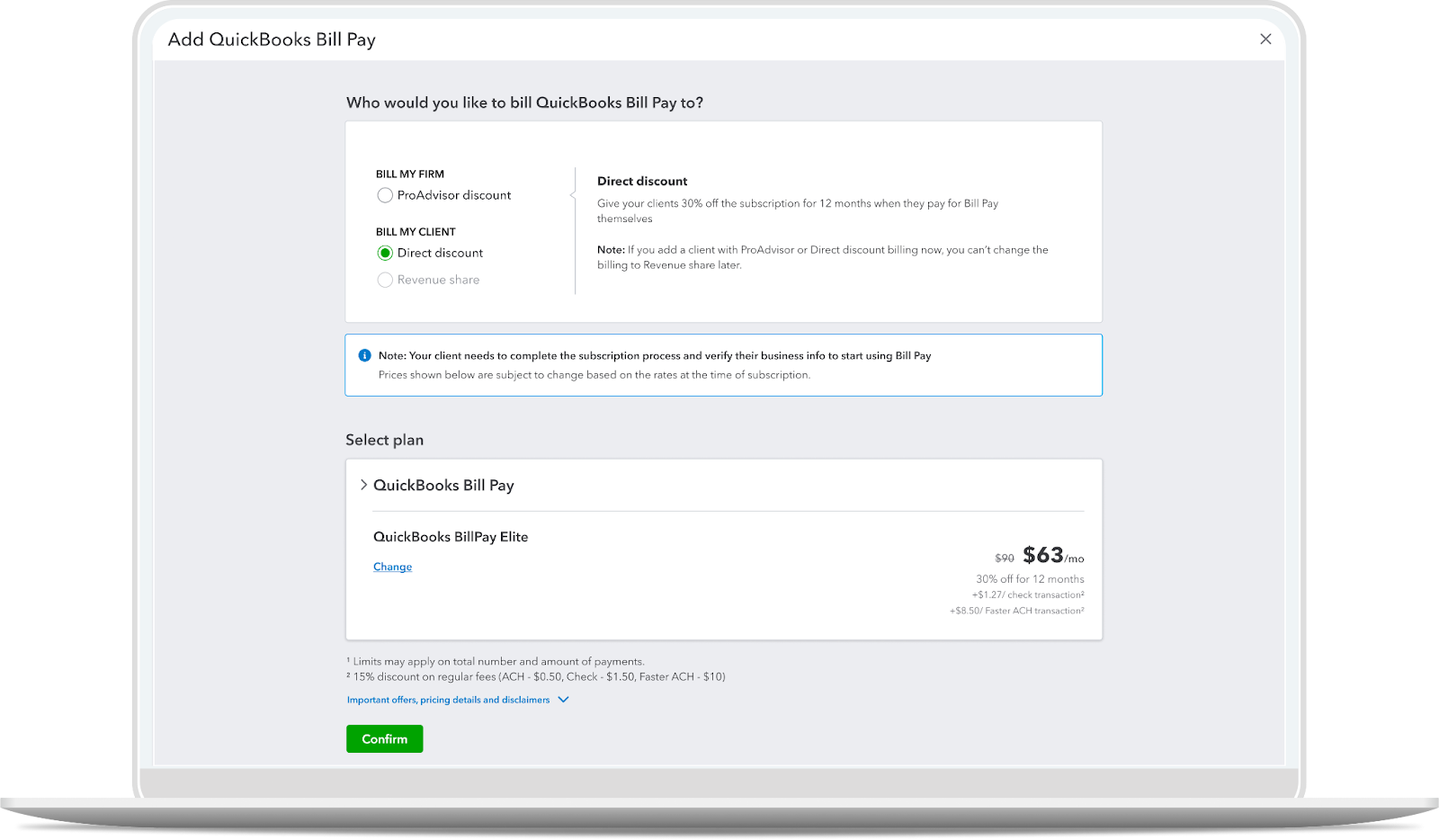

Bill Pay billing updates: ProAdvisor pricing and split billing

In a nutshell: Choose from more billing options for QuickBooks Bill Pay, along with a discount for your clients.

When you enable Bill Pay for a client in Add Product, you’ll see these billing options:

- Bill your firm (accountant-billed) with ProAdvisor Preferred Pricing to give your client ongoing discounts of 30% off their subscription and 15% off transactions*

- NEW: Bill your client (client-billed), and they’ll get 30% off their subscription and 15% off their transaction fees for the first 12 months*

Not only that, you can now mix-and-match billing options for products, including Bill Pay, QuickBooks Online, and QuickBooks Online Payroll. This means your client can pay directly for their Bill Pay subscription and transaction fees, while your firm pays for their QuickBooks Online or other products.

Introducing Intuit Assist for QuickBooks Online

In a nutshell: Intuit Assist helps automate bill and receipt entry, invoice and estimate creation, and knowing what to focus on next.

You and your clients using QuickBooks Online now have a new set of capabilities with Intuit Assist.

Save time entering bills and receipts

Intuit Assist will generate transactions from:

- A bill or receipt you upload in the form (upload file or take a picture, no mobile app required).

- A batch of bills or receipts you upload in the Bill or Sales receipt job centers.

- Bills and receipts sent to your personalized Intuit Assist expense email address (this email is open to any sender, including vendors and employees).

Simplify invoice and estimate creation

- Intuit Assist will generate invoices or estimates from your uploaded documents or typed notes in the form, as well as documents or conversations with customers that you email to your personalized Intuit Assist sales email address.

- Invoice reminders created by Intuit Assist can help your clients get paid 5 days faster on average than with a standard template.1

Know what to do next

At any moment, your client can find out what they should pay attention to. The Business Feed, powered by Intuit Assist, tells them which invoices to collect on, bills to review, and more. With Intuit Assist proactively bringing that information forward, they can skip the AR & AP aging reports and stay on top of all tasks.

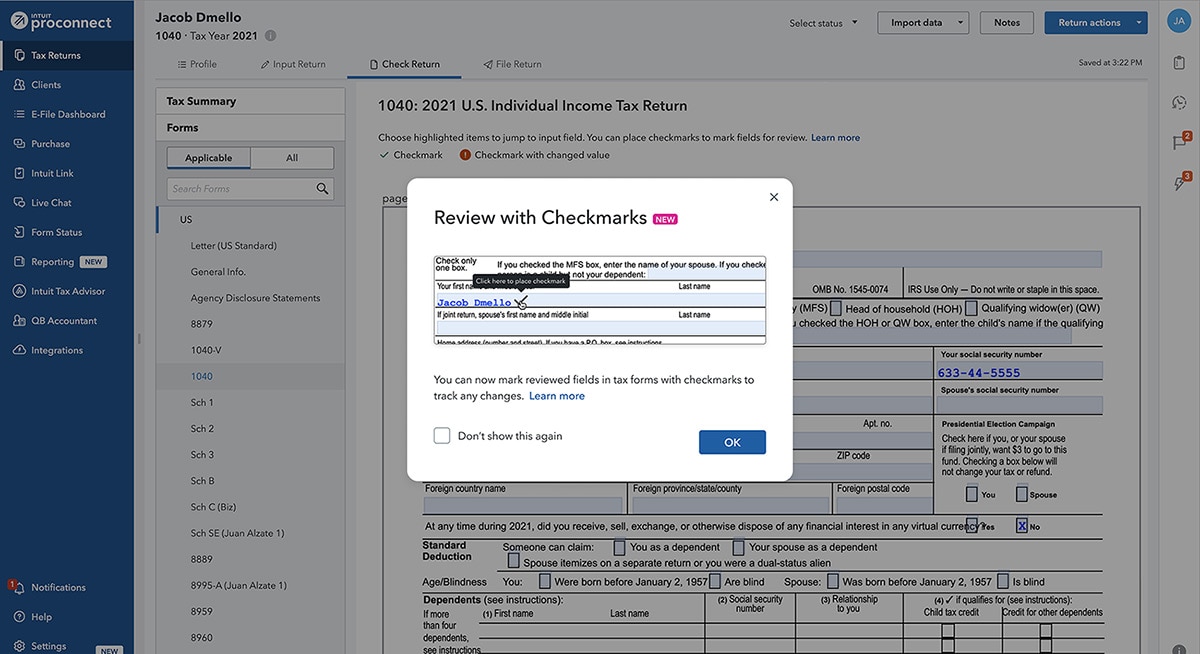

Review checkmarks in Intuit ProConnect Tax

In a nutshell: Intuit ProConnect Tax now provides a tax return review documentation system to help ensure accuracy.

If your firm prepares tax returns with the help of multiple employees, ProConnect Tax has an update you may find very useful.

As clients review values in their tax returns, they can mark them with a checkmark. If the value changes for any reason, the client will see an indicator to show it has changed since their previous review. For efficiency, they’ll be able to review all the checkmarked values or just the values that have changed. Each checkmark will show who made the mark, and revised values will also show the original checked value.

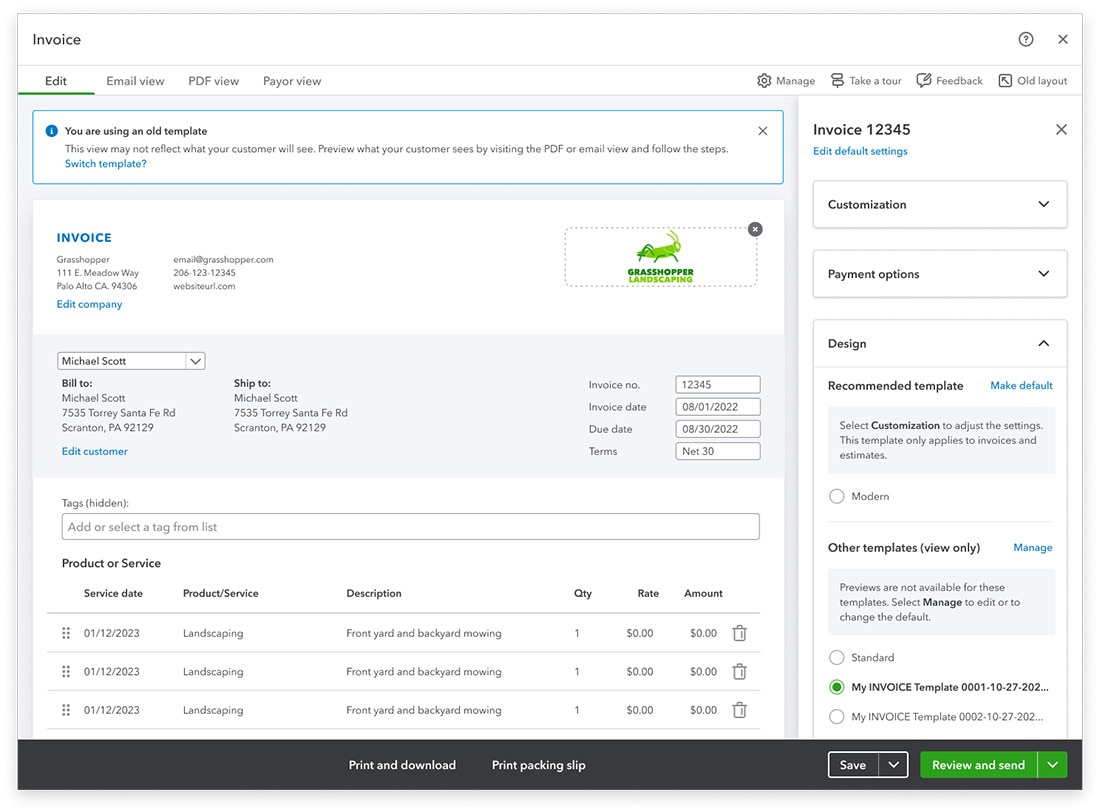

Invoice improvements you requested

In a nutshell: In response to customer feedback, QuickBooks Payments has recently launched 80+ new invoicing features.

You asked, we delivered. These new features provide an enhanced invoicing experience:

Better capabilities

- Adjust tax rates

- Add billable expenses grouped by time

- Use price rules

- Customize your invoice template while drafting an invoice

Convenient additions

- Access existing templates

- Show, hide, and rename columns

- Change color and font from the invoice

Quicker access

- Use keyboard shortcuts to access invoicing features faster

- Receive payments with one-click access

- Autosave your work in the QuickBooks Online mobile app

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.