Happy New Year! We wish you and your clients a prosperous year ahead. January is National Mentoring Month, so this might be a good time to make sure any young talent at your firm has what they need to strengthen their careers. For example, you can encourage their professional development, plus help them stay current on the latest updates below.

QuickBooks Online new features and updates—January 2025

Share these QuickBooks updates with your associates and clients of the latest innovations relevant to business owners and admins.

Table of contents

Table of contents

Stay In the Know

Learn about the most exciting innovations. Visit the Hub to watch weekly videos or join us for a live webinar on Thursday, February 20 at 11 AM PT.

2024’s accountant-inspired features—and those on the horizon

In a nutshell: Get a recap of the past year’s updates designed to bring more efficiency, control, and insight to your work—plus a glimpse of what’s to come.

In connecting with accountants, we’ve learned that as we continue to add new functionality, many firms are seeing the benefits of standardizing with QuickBooks Online. Every update is a push to provide an even better family of products to help you and your clients work efficiently, with control, to make confident decisions.

Just this year, we introduced:

- Intuit Enterprise Suite powered by QuickBooks and Mailchimp, a holistic online solution for seamless multi-entity reporting and accounting

- Intuit Assist for QuickBooks Online to automate more of your AR/AP processes

- An updated bank feeds experience in QuickBooks Online, updated with more information and functionality so you can work with transactions in fewer clicks

- Paycheck corrections in QuickBooks Online Payroll, so you can have more confidence running payroll

- Product recommendations for clients in QuickBooks Online Accountant, products curated for your clients based on potential cost savings

Get the full list of 2024’s top enhancements in QuickBooks Online and its connected services—plus a preview of those on the horizon.

Updates released in Intuit Enterprise Suite

In a nutshell: Check out all the latest updates to Intuit Enterprise Suite.

To serve clients with complex needs, we recently launched Intuit Enterprise Suite to deliver a scalable, integrated multi-entity platform designed to enhance productivity and profitability.

Because we’re always innovating, we’re excited to share many updates in the December release including:

- Multi-entity accounting & financial management: For example, with role visibility across entities you can save time and improve oversight by quickly seeing who has access and to what, without having to go to each entity.

- Dimensions and business intelligence: For example, categorization by dimensions in the bank feed lets you improve efficiency and reduce the need for later adjustments by managing the categorization of your transactions at the point of data entry.

- Automation and connected tools: For example, with recurring payments from your customers you can ensure a consistent, predictable source of income and cash flow by scheduling recurring payments with your customers.

- Industry-specific customizations: For example, Knowify data integration lets you reconcile payments faster by linking to QuickBooks Payments in invoices sent with Knowify.

- Dedicated partnership: For example, Intuit Enterprise Suite training subscription helps you get the most out of Intuit Enterprise Suite and outsource training, so you can onboard new users without missing a beat.

Discontinuing tags and switching to custom fields in QuickBooks Online

In a nutshell: In QuickBooks Online, you will no longer be able to create tags as of March 8, 2025.

If you or your clients are currently using tags, here are a few facts to keep in mind:

- From February 5, 2025 to March 7, 2025, you and your clients can migrate your tags to a custom field.

- From March 8, 2025 to April 30, 2025, you and your clients will have read-only access to your tags. Be sure to download reports for your tagged transactions to keep for your records.

- As of May 1, 2025, tags will be removed from QuickBooks Online, and you’ll no longer be able to run reports for tagged transactions.

In QuickBooks, custom fields are a versatile alternative to tags. With custom fields, your clients can capture data that’s important to their businesses and get actionable insights by running reports on these new data points. For example, they could create a “Sales rep” field to appear on all sales forms and later generate reports on sales per rep.

Note: Custom field availability varies by QuickBooks Online plan. As you can see from the table below, we’ve added a custom field to most plans. This change is being rolled out to all customers, regardless of their use of tags. Custom fields will support both sales and expense forms.

Collaborate with clients using QuickBooks Solopreneur

In a nutshell: An accountant-side experience is now available to accountants who work with QuickBooks Solopreneur subscribers.

As with clients using other subscriptions, you’ll be able to see a Solopreneur client’s books in QuickBooks Online Accountant after accepting their invitation to collaborate. There, you can work with them more easily and efficiently by reviewing their Chart of Accounts, transactions, and reconciliation, as well as accessing their account registers, journal entries, and accountant reports.

When working with your Solopreneur clients, you may notice slightly different capabilities:

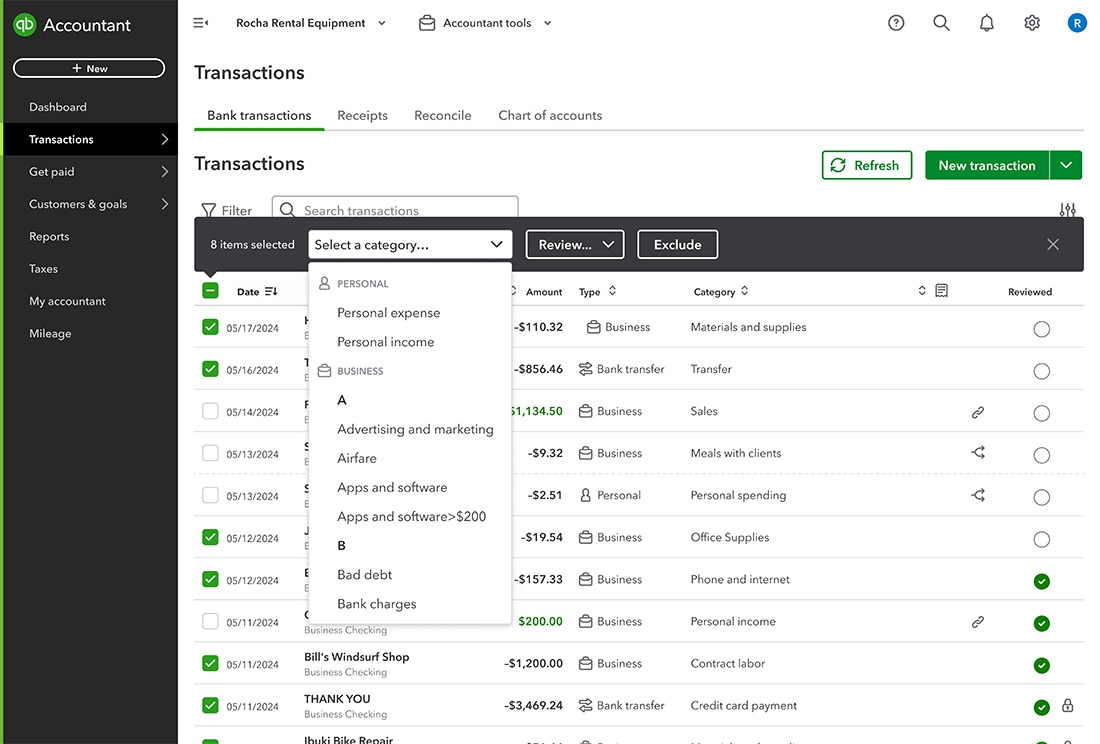

- Automatic categorization: To reduce the time you spend categorizing tasks, you won’t need to manage uncategorized transactions. Instead, clients’ transactions are automatically identified as business or personal, and then they’re automatically categorized into an account based on a number of factors including categories that appear on tax forms. You’ll be able to update transactions one at a time or in batches. To help sharpen future auto-categorizations, QuickBooks learns from the corrections you make.

- Efficient Transactions view and workflow: Manage clients’ books more efficiently and focus on reviewing rather than categorizing with an updated view that reflects auto-categorized transactions. These improvements help streamline your bookkeeping workflow so you can focus on strategic tasks or take on more small clients.

- Review checkmarks: Help increase bookkeeping accuracy and get a more straightforward view of work left to do with a new, intuitive checkmark. As you review the Bank transactions list, you can use this new checkmark to point out the transactions you’ve already reviewed. If your client makes a change to the list you reviewed, your previous checkmark will clear and you’ll be able to easily identify it.

Updates and added options for migrating to QuickBooks Online

In a nutshell: Take advantage of several new updates that help simplify and customize migrating from QuickBooks Desktop to QuickBooks Online.

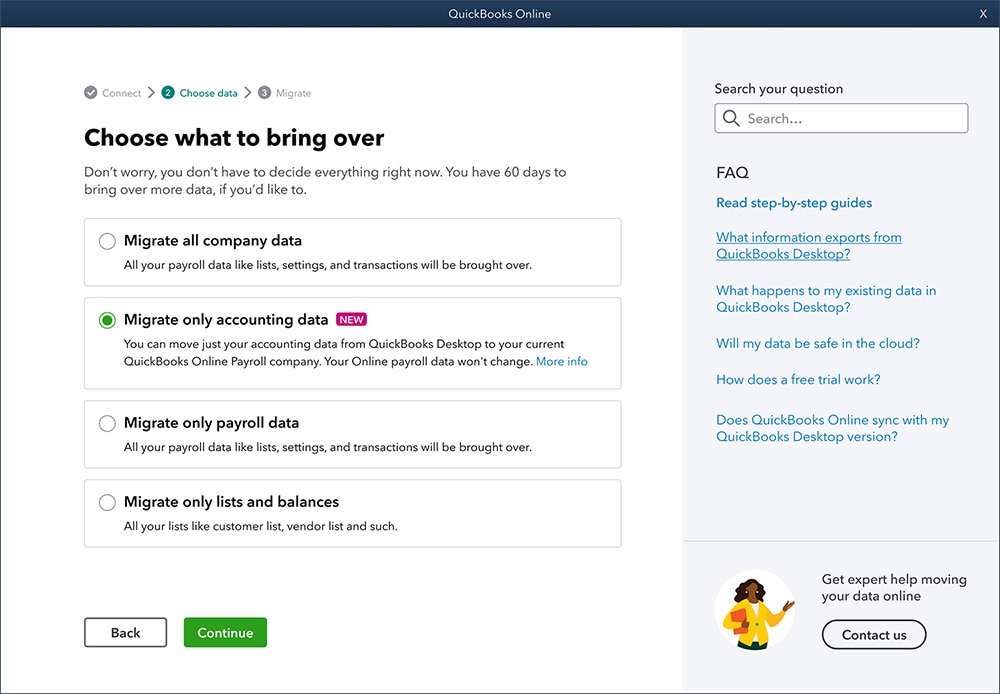

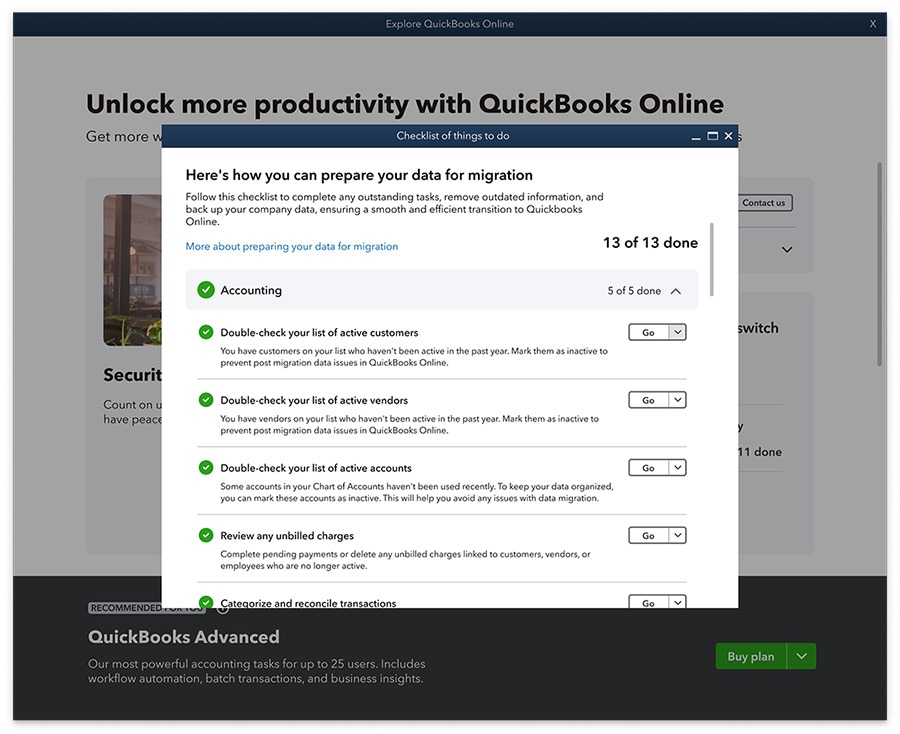

To help accountants and their clients migrate to QuickBooks Online, we continually look for ways to improve the experience. We’re excited to share a few new updates:

- Migrate accounting data to an existing QuickBooks Online Payroll company: If your client currently uses QuickBooks Online Payroll and you’re ready to move their accounting online, you can help them seamlessly manage all aspects of their business in one place. Now, you can choose to import their accounting data from QuickBooks Desktop, and it won’t affect their existing online payroll data.

- Migrate up to 1.2 million line items: Now, you can migrate older or larger clients that have more QuickBooks Desktop data. Rather than the previous limit of 750,000 targets, you can migrate 16 times that per client to QuickBooks Online.

- A pre-migration checklist for accountants: Keep track of important tasks to complete before starting migration to help ensure your client’s company file is ready to make the move. You can view this checklist from the online migration tool to track your progress and make sure you don’t miss any steps.

- AI-based migration duration estimate: Get more control over your schedule by getting a better sense of when a client’s data will be fully migrated to QuickBooks Online. The online migration tool and the Batch Migration Tool now provide a smart, AI-based time estimate to let you know how long each migration may take.

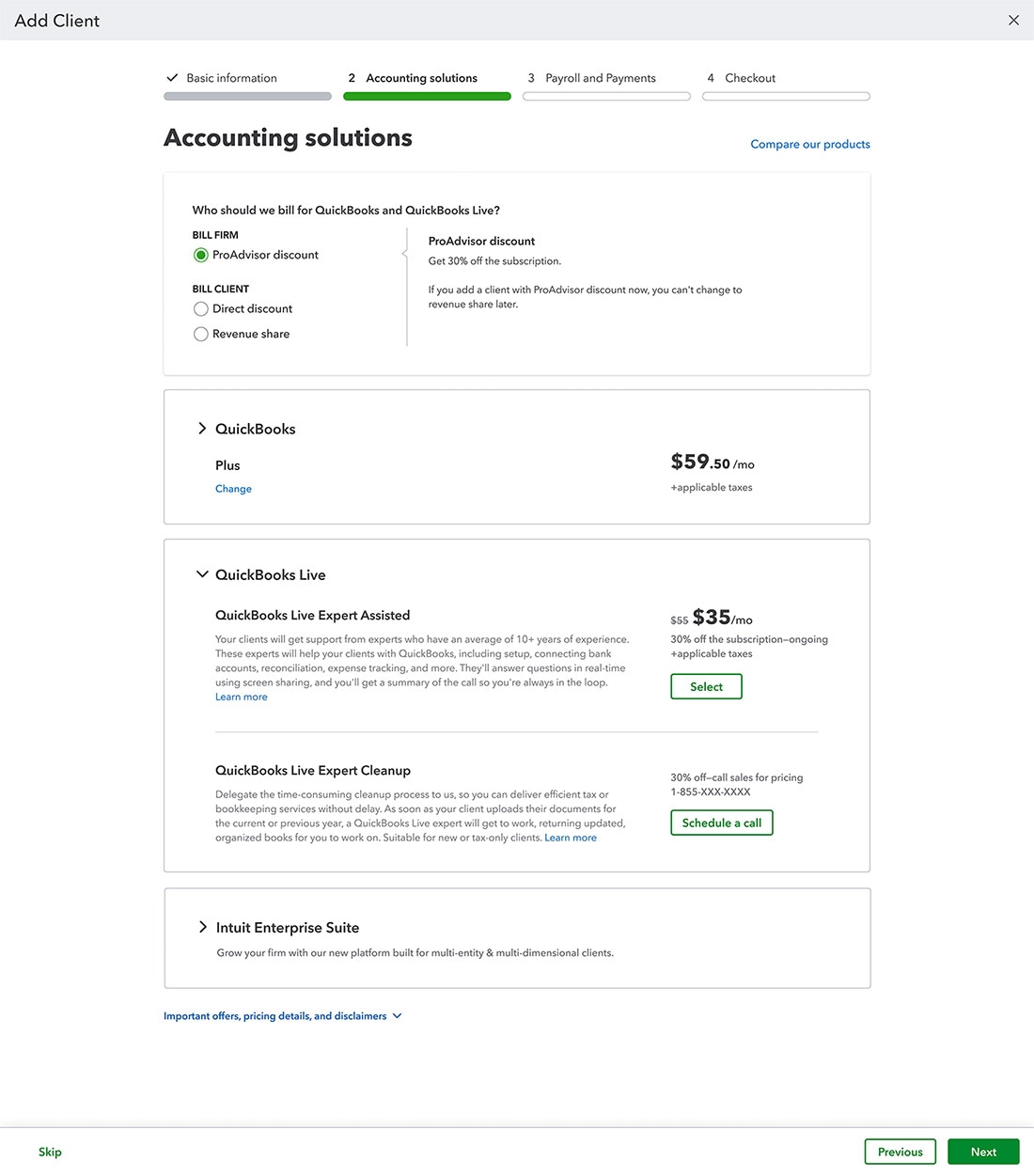

QuickBooks Live Expert Cleanup now available to supplement your team

In a nutshell: Help bring a client’s books up-to-date for tax time with QuickBooks Live Expert Cleanup.

Firms are busier than ever, and resources can stretch thin at key times of the year. Thankfully, you no longer need to turn clients away when they have messy books. QuickBooks Live Expert Cleanup can get their books ready for the prior and current tax years while freeing up your firm to focus on advisory, tax, or other bookkeeping services.

When you outsource a one-time cleanup of a client’s books, a QuickBooks-certified bookkeeper will ensure the client’s books are up to date within 30 days. This service is a great alternative for clients who need to clean up their books for tax year 2024 but do not need ongoing Live Bookkeeping support.

QuickBooks Live Cleanup includes:

- Tax-ready books cleanup with treatment tailored to year-end needs

- A package of year-end financial reports

- An optional wrap-up call experience

Pricing varies by time period and is determined by a tiered structure. Books cleanup for the prior tax year is priced at a flat rate of $800. For the current tax year, books cleanup is priced at a monthly fee of $150. For more information, call Sales at 800-624-0213.

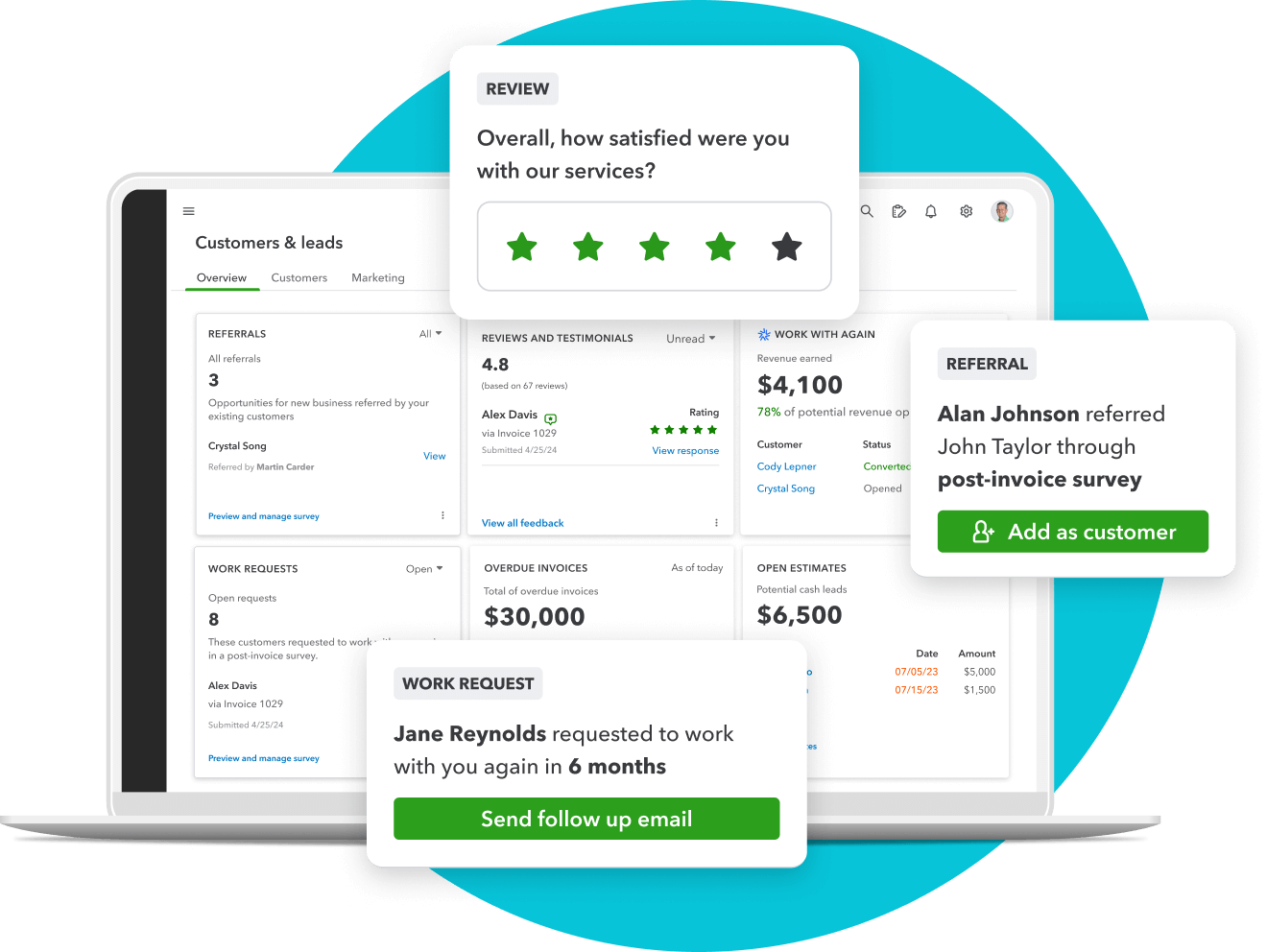

QuickBooks Customer Hub powered by Mailchimp

In a nutshell: Clients using QuickBooks Online and QuickBooks Online Payments can use a powerful and proactive set of tools to help them grow their revenue.

Many businesses that seek sustainable growth rely on word of mouth, nurturing relationships, and customer satisfaction.

Your clients using QuickBooks Online and Payments can utilize QuickBooks Customer Hub to strengthen their customer relationships.** Here, they can access tools to gain valuable feedback, connect with new prospects, and encourage repeat business.

From QuickBooks Customer Hub, in the Customers & leads tab in QuickBooks Online, your clients can manage:

- Reviews and testimonials: where they can build stronger relationships by encouraging customers to rate and share their satisfaction.

- Referrals: where they can connect with prospective customers by giving their current customers a simple way to recommend their product or service.

- Work requests: where they can automatically enable their customers to request repeat business or new services.

Clients can add QuickBooks Customer Hub for $15 per month, with the first month free.*

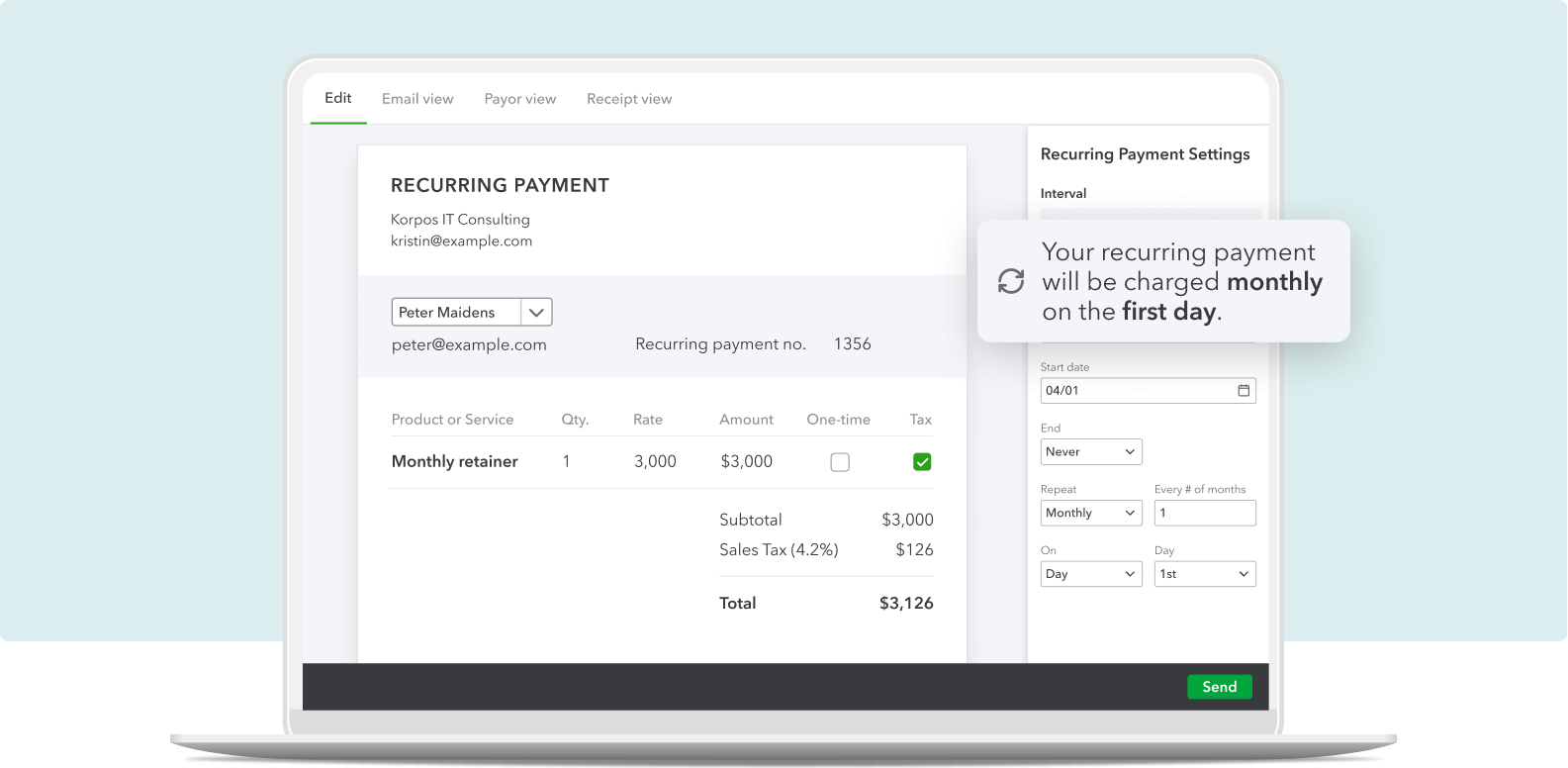

Help clients get paid automatically with recurring payments

In a nutshell: By scheduling recurring payments in QuickBooks Online Payments, your clients can automatically charge their customers, eliminating the need to keep up with payment on recurring invoices.

Rather than having to pester customers for payments or suffer a cash flow crunch, your clients can choose to schedule recurring payments to manage ongoing charges. This helps ensure continuous cash flow and minimizes disruptions and manual work.

When your client sets up recurring payments for their customer, QuickBooks will email that customer a link to accept the terms and enter their payment info. Your client will not need to maintain card on file records, since QuickBooks Online securely stores their customer’s info for future payments.

QuickBooks then charges the customer automatically on schedule, so your client gets paid on time, every time. Clients’ books will update automatically with each recurring payment, saving up to 60% of the time you’d otherwise spend matching transactions year-round.**

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.