March is here, which means your tax teams are still in the thick of their busy season—a great time for free tax resources for you and your clients. In addition, March 7 was National Employee Appreciation Day, so consider sharing a few heartfelt words with your teammates. Don’t forget to catch up on this month’s updates below.

QuickBooks Online new features and updates—March 2025

Share these QuickBooks updates with your associates and clients for the latest innovations relevant to business owners and admins.

Table of contents

Table of contents

Stay In the Know

Learn about the most exciting innovations. Visit the Hub to watch weekly videos or join us for a live webinar on Thursday, March 20 at 11 AM PT.

Manage work in new ways in QuickBooks Online Accountant

In a nutshell: The Manage work tab in QuickBooks Online Accountant has a refreshed design that helps you get things done more efficiently.

You can manage Projects and All tasks with fresh new functionality:

- Save time by creating standalone tasks

- Organize and search in more detail with more robust filters

- Work more quickly with improved performance

Plus, it’s all redesigned with a modern look.

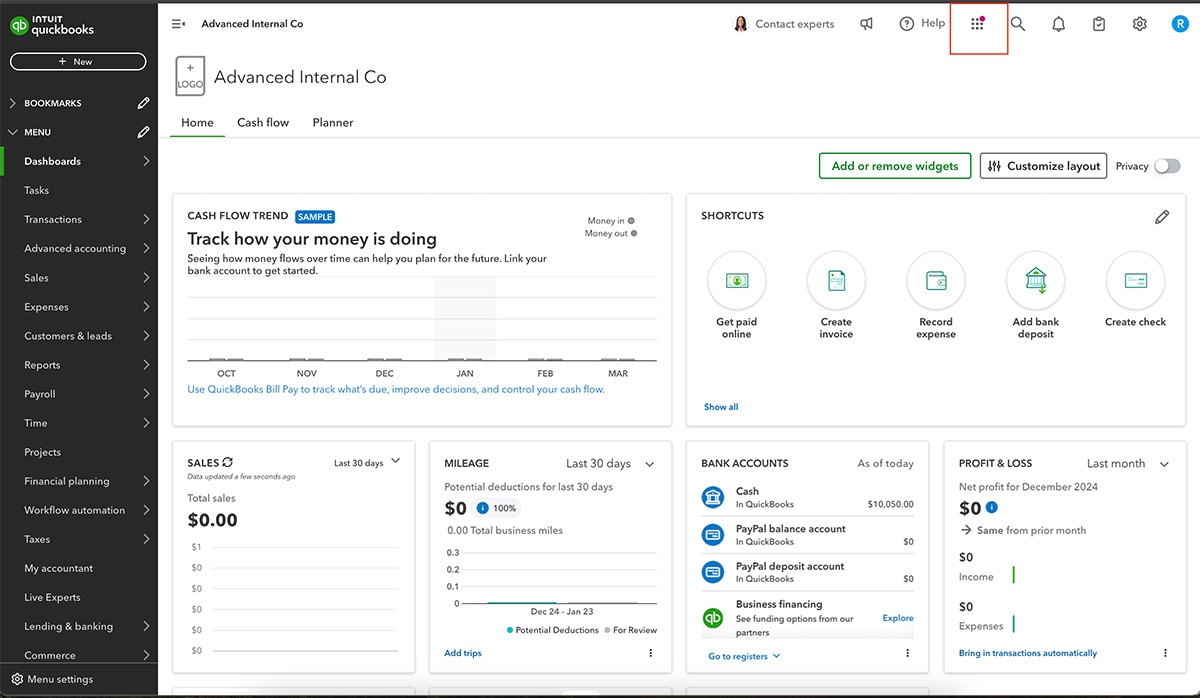

Address app connection errors efficiently with high-visibility notifications

In a nutshell: Know right away in QuickBooks Online if an app needs attention.

When you or your client uses connected apps with QuickBooks, it’s important to have visibility on how the apps are operating. Now, if an app is experiencing a connection error, you will see an indication in the main header of QuickBooks Online. The apps symbol that normally shows nine grey dots will include a red dot. After clicking this symbol, you’ll see a dropdown displaying each app with an added red flag to indicate which one is having a connection issue. From there, you can click through for more information so you can take care of it.

The sooner you know an app needs attention, the faster you can address it—and enjoy the productivity, efficiency, and confidence you get when all connected apps are working as expected.

Boost productivity by switching clients from QuickBooks Self-Employed to QuickBooks Solopreneur

In a nutshell: If you have clients using QuickBooks Self-Employed, they can now enhance what’s possible in QuickBooks by switching to QuickBooks Solopreneur.

Just as in other QuickBooks Online subscriptions, your client can invite you to view and work in their books. QuickBooks Online Accountant will have the tools you need to work with their data:

- Reconciliation

- Chart of Accounts

- Transaction review

- Account registers

- Journal entries

- Reports

The accountant experience for Solopreneur now includes three unique capabilities:

- Simplify the workload with auto-categorization: Transactions are first automatically determined to be either business or personal, then they’re auto-categorized into the best account. As you review and correct them over time, Solopreneur’s suggested auto-categorizations become more accurate.

- Enhanced organization with updated Transactions view: The transactions list updates to reflect auto-categorizations, so you can focus on reviewing rather than categorizing.

- Track your work with review checkmarks: Mark the transactions you’ve reviewed using an intuitive checkmark in the Banking transaction list to help you and your team understand what work remains to be done.

Note: When your client upgrades to QuickBooks Solopreneur, up to seven years of their data, including bank connections and transactions, receipts, invoices, mileage, customers, account info, and settings data will move with them. Data in other categories and data older than seven years will not move to QuickBooks Solopreneur, so for reference, you might consider downloading a backup. After upgrading, your client will no longer be able to access data in their QuickBooks Self-Employed account.

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments’ money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

**Features

Syncing bank and cards: Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions, and fees.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

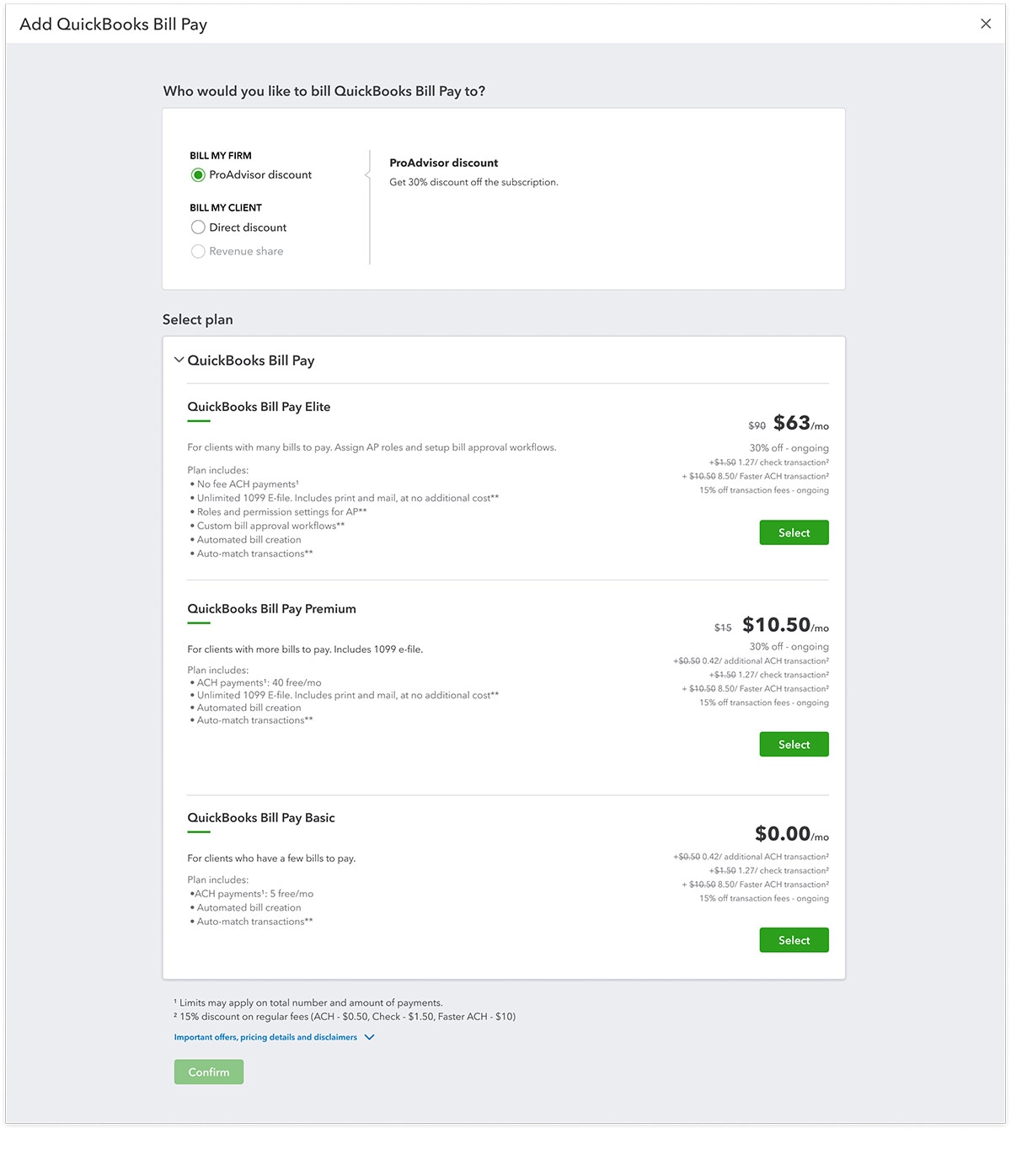

Simplified Bill Pay subscription process for accountant-billed clients

In a nutshell: It’s simpler to add Bill Pay for your clients on an accountant-billed (firm-billed) basis.**

Rather than rely on multiple back-and-forth steps, you can now subscribe a client directly to the Bill Pay plan that suits their needs. After that, the client will be prompted to complete an application form with 27 days to do so. After they’re approved for Bill Pay, they’ll be able to use it right away.

Note: If a newly subscribed client doesn’t complete their application within the 27-day window, the client’s Bill Pay account will be closed and your firm will be credited for the Bill Pay subscription fees paid.

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments’ money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Bill Pay: QuickBooks Bill Pay account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Not available in U.S. territories or outside the U.S.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.