Sometimes clients need more product and bookkeeping guidance than your team has resources to provide. To help your firm deliver valuable services to your clients, you can partner with QuickBooks Live Expert Assisted right in QuickBooks Online Accountant.

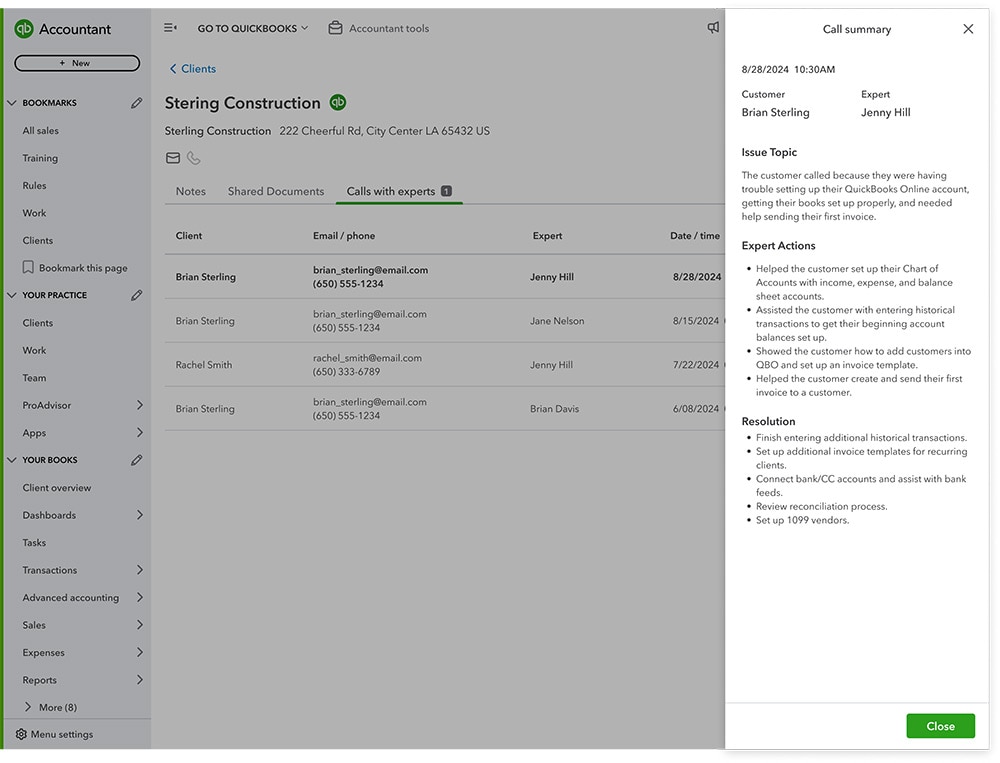

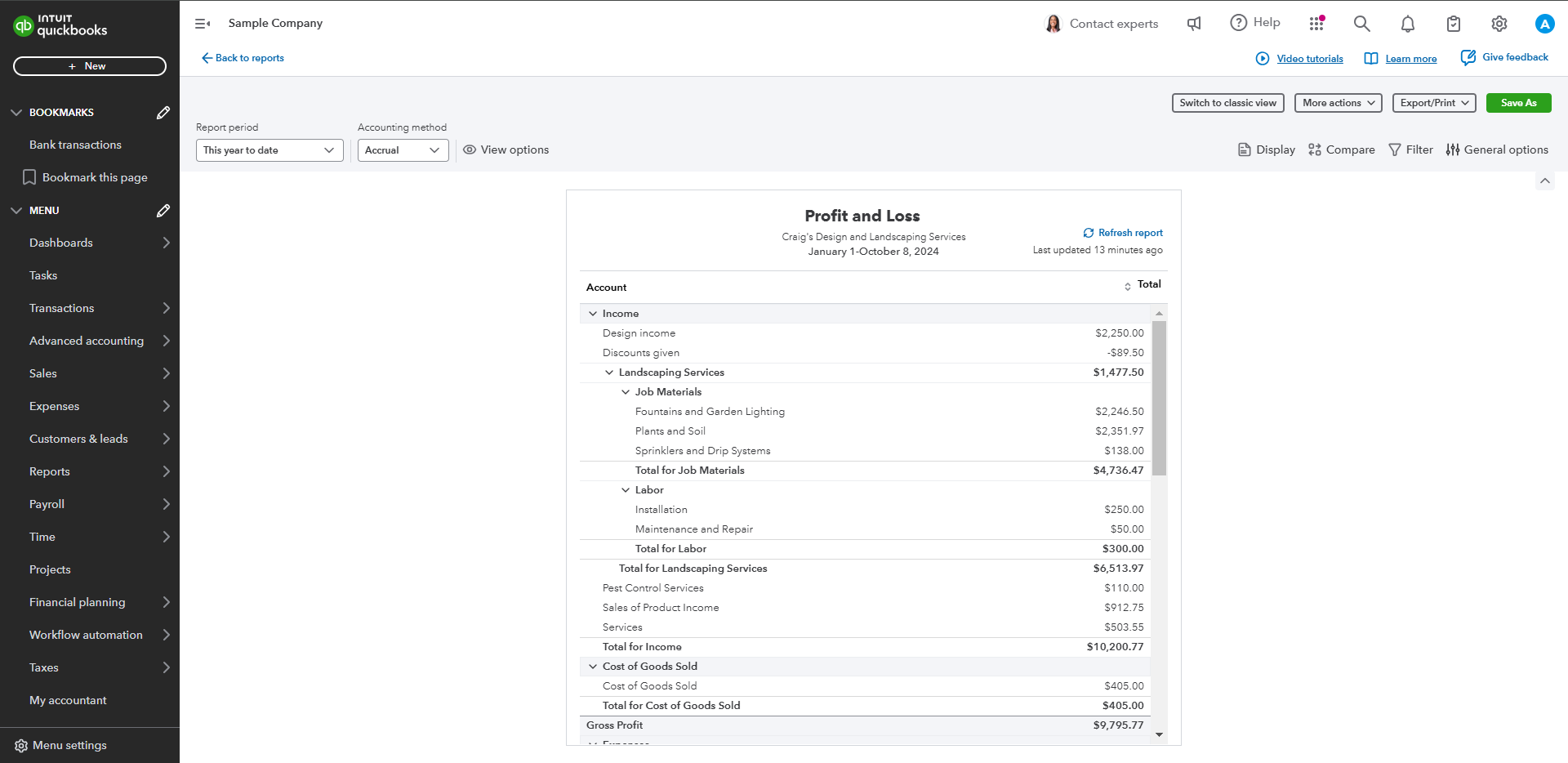

You can help increase your firm’s capacity by adding QuickBooks Live Expert Assisted to your client-service team. When you add it to your client’s subscription, they’ll get access to set-up support, as well as product and bookkeeping answers—including setting up bank accounts, managing a Chart of Accounts, reconciliations, invoices, expense tracking, and more.

Our experts have an average of 10 years’ experience.** They can troubleshoot your client’s questions in minutes, using video, phone, and screen-share capabilities, without ever touching your clients’ books.

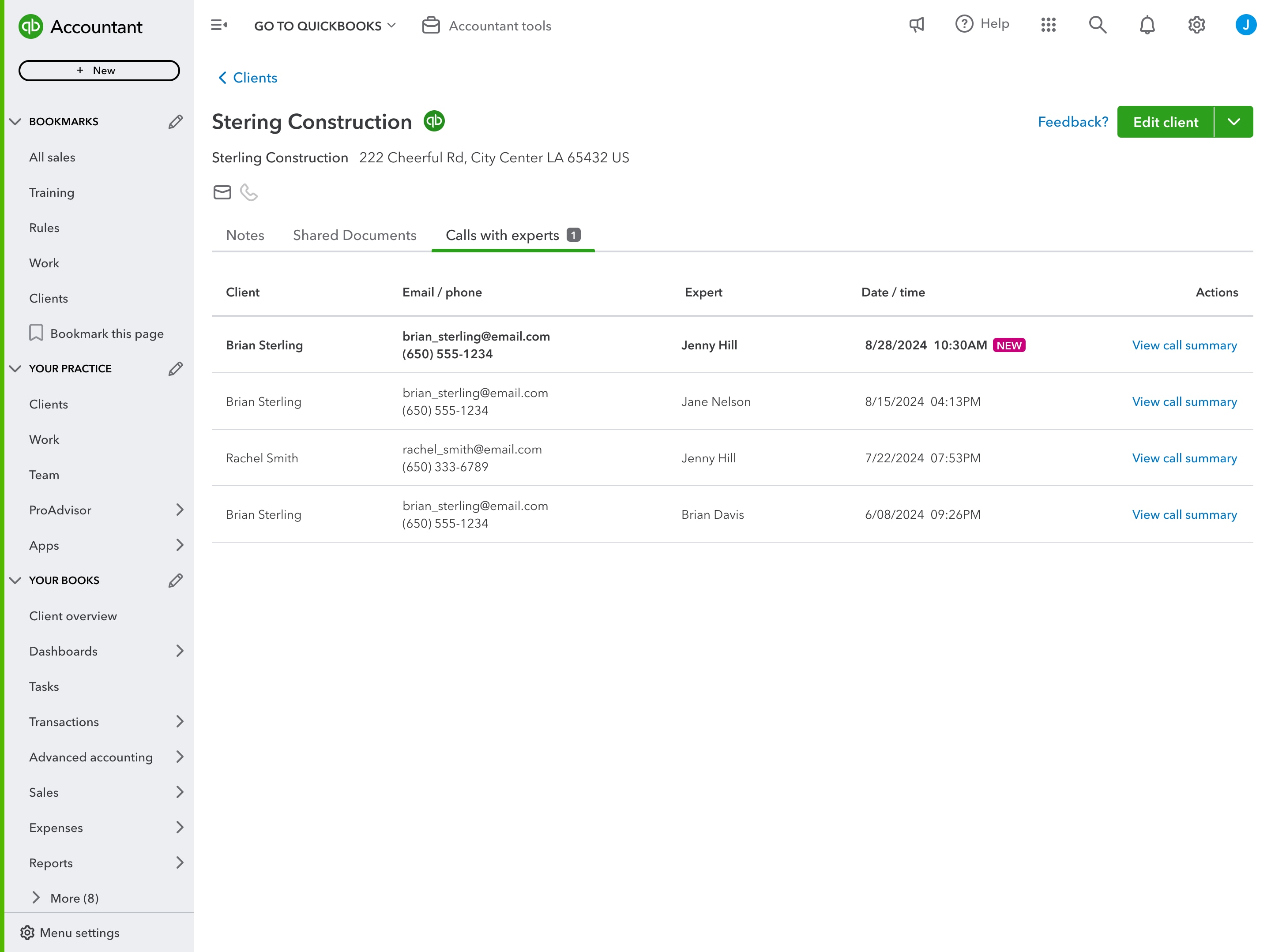

In addition, you’ll always be in the know on each client’s calls with our experts. You can access automated call summaries right from your QuickBooks Online Accountant dashboard. To give you enhanced visibility, each one will show you the client’s questions and how the QuickBooks Live expert responded.

Rather than spending hours educating clients, or picking and choosing which clients to take on, add QuickBooks Live Expert Assisted.

Note: QuickBooks Live Expert Assisted experts do not access or do work within your clients’ books or financial data. This solution can be billed to your firm or to your client.