Did you know October is Financial Planning Month? Now is a perfect time to take control of your expenses, strategize about scaling your firm, and set yourself up for sustainable long-term growth. Don’t forget to explore the latest tools to help your clients with their financial planning.

QuickBooks Online new features and updates—October 2024

Share QuickBooks updates with your associates and clients: Send them this link for the latest QuickBooks innovations that are relevant to business owners and admins.

Table of contents

Table of contents

Stay In the Know

Learn about the most exciting innovations. Visit the Hub to watch weekly videos or join us for a live webinar on Thursday, October 17 at 11 AM PT.

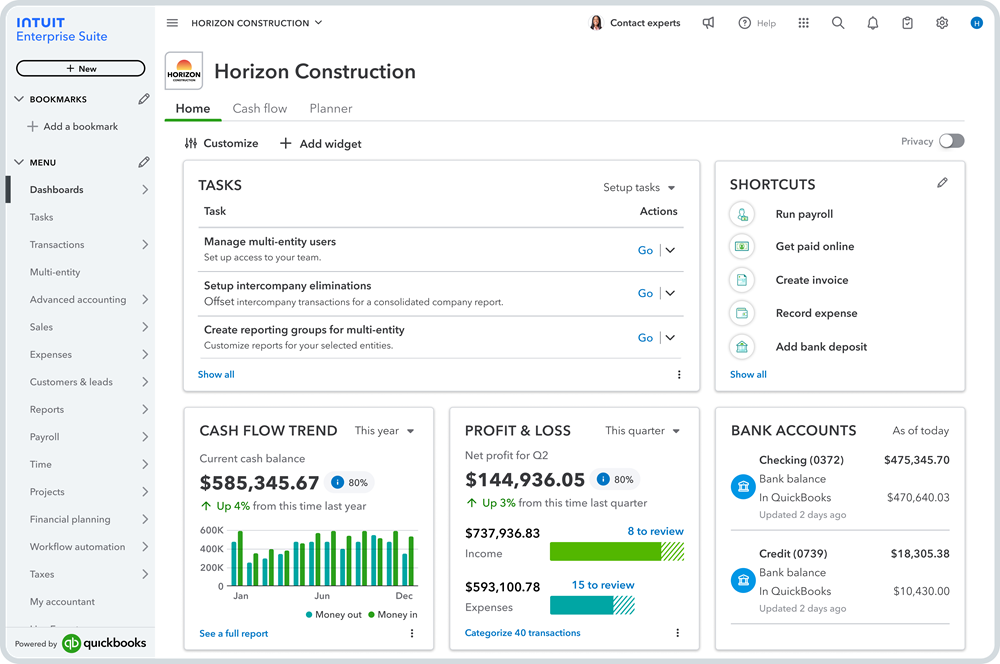

Power growth for complex clients with Intuit Enterprise Suite

In a nutshell

Intuit Enterprise Suite is a new cloud-based, multi-entity, and multi-dimensional platform that enhances productivity and profitability for clients with complex business needs.

Many firms have expressed their desire to serve larger, multi-entity clients’ needs while simultaneously streamlining operations on a familiar platform. Their primary objectives are to enhance firm workflow efficiency, minimize training time for employees and clients, and avoid costly and time-consuming migrations. These firms aim to achieve all this without compromising on multi-entity, multi-dimensional, and industry-specific solutions, as well as the powerful insights that these growing clients require at this stage.

Intuit Enterprise Suite shows our investment in building seamless platform solutions that meet all these needs and goals.

With Intuit Enterprise Suite, you and your clients can:

- manage multi-entity businesses from end-to-end in one place

- get seamless accounting that flows into cross-entity and P&L reports

- connect projects to profit with accurate labor costs and profit per employee

- drill down with multidimensional reports across user-defined hierarchies to make confident decisions about resources, performance, and upcoming projects

- streamline efficiency and cash flow by connecting data with AI-powered automation throughout and across entities

- access real-time KPI data with customizable dashboards

With Intuit Enterprise Suite, clients will have the tools to keep growing—with custom roles and controls on user permissions, seamless third-party integration, and access to payroll and benefits. Intuit Enterprise Suite will also help clients grow their businesses without the need for expensive enterprise resource planning software, and it will help your firm achieve its business goals and attract high-revenue clients.

We’re excited about our new platform, and we’re sharing that excitement with you. As part of our revenue share program, you can earn $1,500 for each active Intuit Enterprise Suite contract you refer through QuickBooks Online Accountant.*

Register for the Introduction to Intuit Enterprise Suite webinar on October 16, 2024 at 10 AM PT to see product demonstrations, learn more, and earn CPE credits.

*Terms and Conditions

The Referral Bounty Program offers a one-time $1,500 bounty for each active Intuit Enterprise Suite contract resulting from referral made by QuickBooks Online Accountants enrolled in the ProAdvisor Revenue Share Program and you can sign up here. We encourage participants to engage in follow-up calls with the Intuit Enterprise Suite team and any additional calls with the referred client to ensure a smooth onboarding process. If the accountant does not participate in these calls, Intuit will take over the communication with the customer. The bounty is paid after the first billing event post contract signing alongside any applicable revenue share payments. This program is not a revenue share initiative and bounty payments are non-transferrable and subject to ProAdvisor's tax obligations. We reserve the right to modify or terminate the program and resolve disputes at our sole discretion.

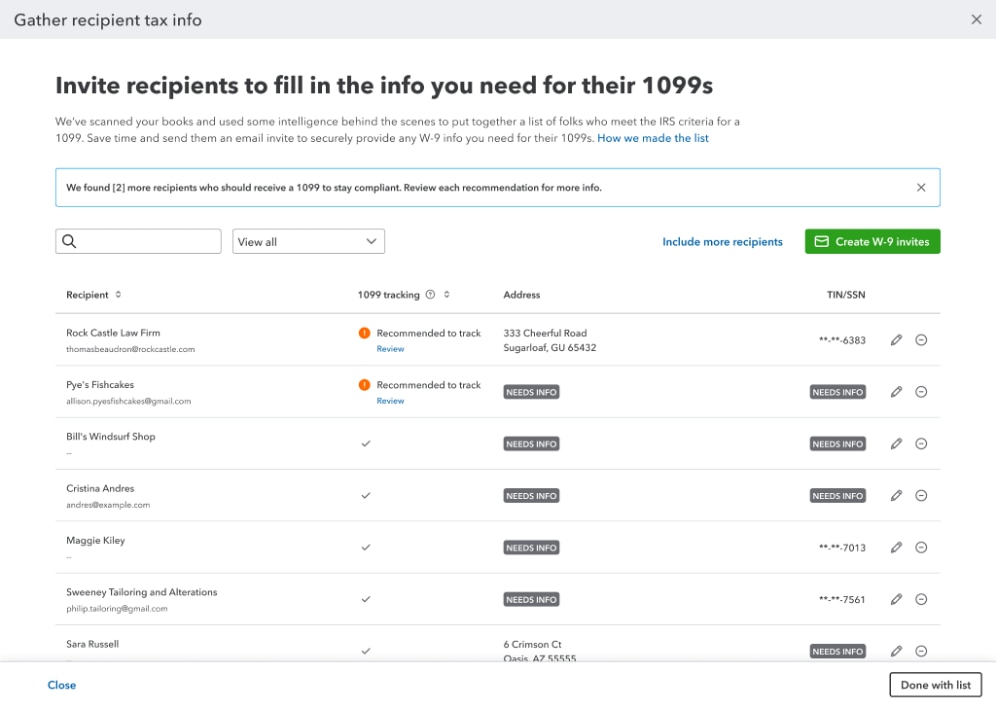

Get ready for tax season with a W-9 management tool

This new module allows you to see a list of vendors who are likely to require a Form 1099 and what info may still be needed to complete all 1099s. Send email invites to vendors who are missing W-9 info, like tax ID or address, in a single step.

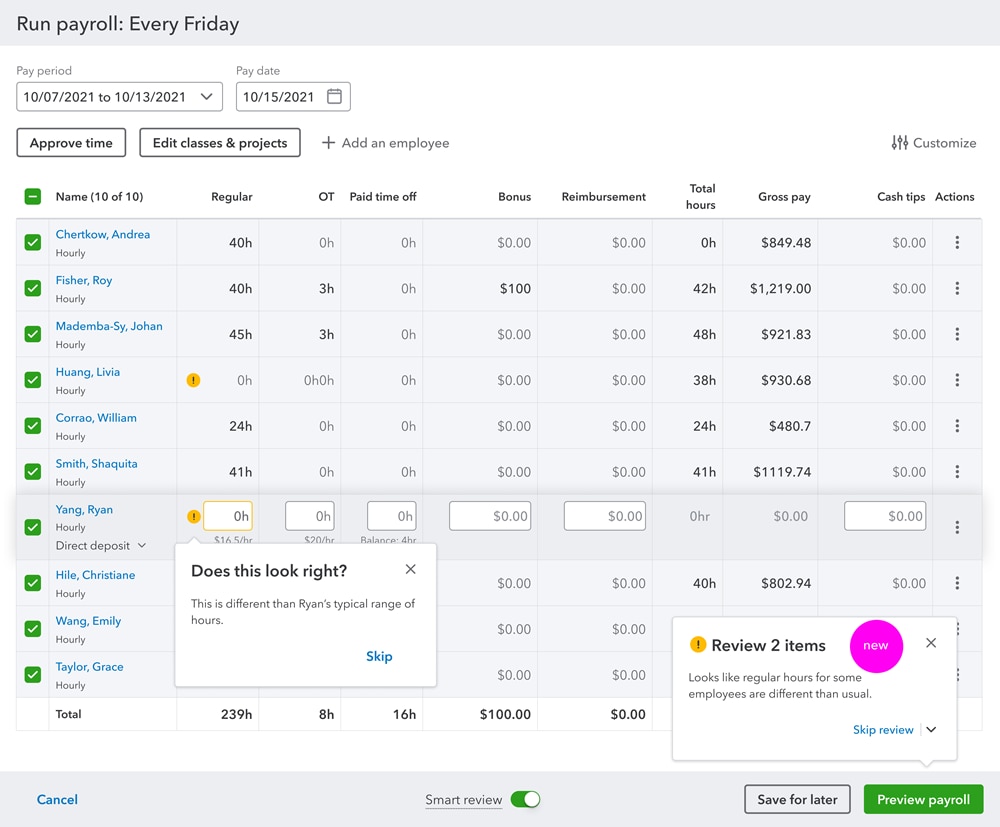

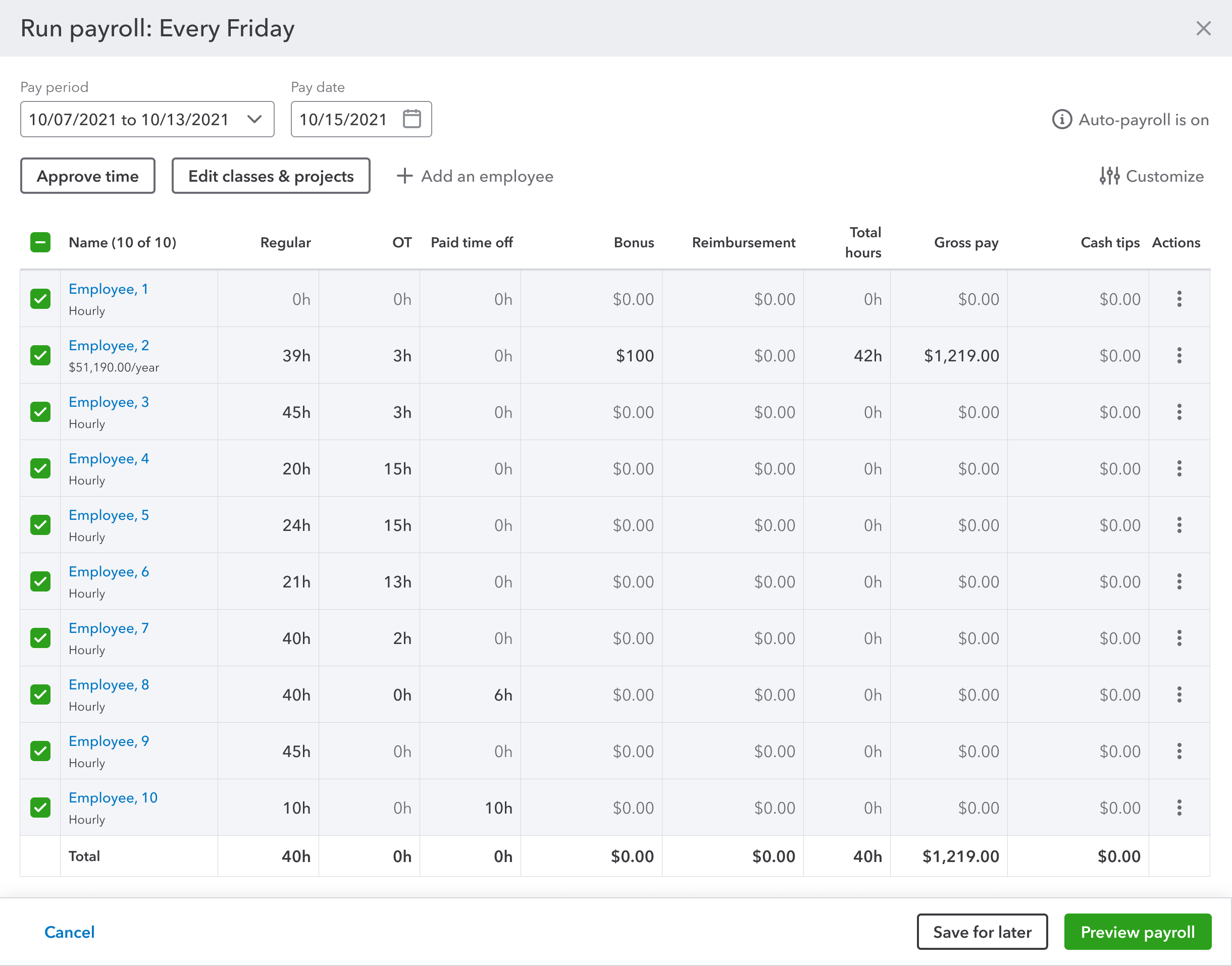

Flag mistakes before running payroll with anomaly detection

Running payroll is a crucial task. Clients that use QuickBooks Online Payroll now have the help of AI-powered anomaly detection, which uses AI to help flag payroll mistakes before payroll is run. This feature helps identify errors in hours-worked data for regular, hourly pay types so mistakes can be detected and resolved in real time—keeping clients’ employees happy and avoiding lost time and money on inaccurate payments.

Anomaly detection is active in QuickBooks Online Payroll by default. However, you can turn it off at any time.

Note: This feature only applies to payroll payments made for pay type “regular hours.”

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

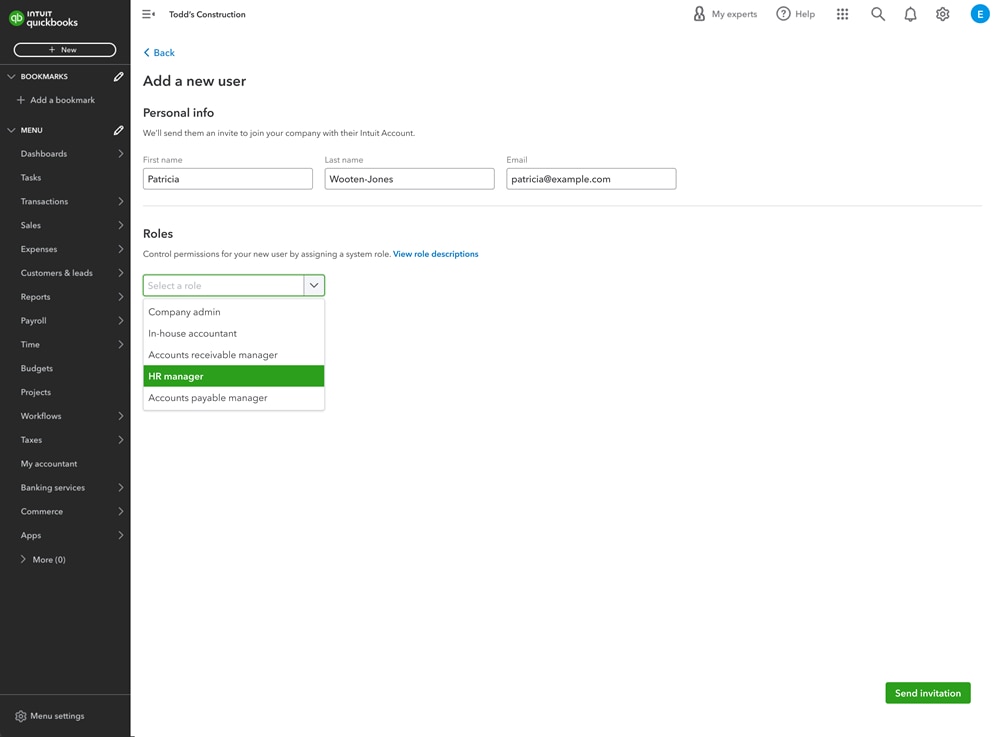

Assign an HR manager role for payroll-only access

In a nutshell

If you or your clients use QuickBooks Online Payroll Elite, you’ll see a new role you can assign: HR manager.

The HR manager role has full access to HR, payroll, and time-tracking items in QuickBooks Online and QuickBooks Online Payroll but doesn’t have access to the company’s financial data. To avoid unauthorized access to financial data, you no longer need to rely on a primary admin to handle payroll tasks. Delegate these duties to an HR manager to free up higher-level team members and help ensure payroll runs on time.

Note: The HR manager role is available to QuickBooks Online Advanced, Plus, or Essentials subscribers who use QuickBooks Online Payroll Elite.

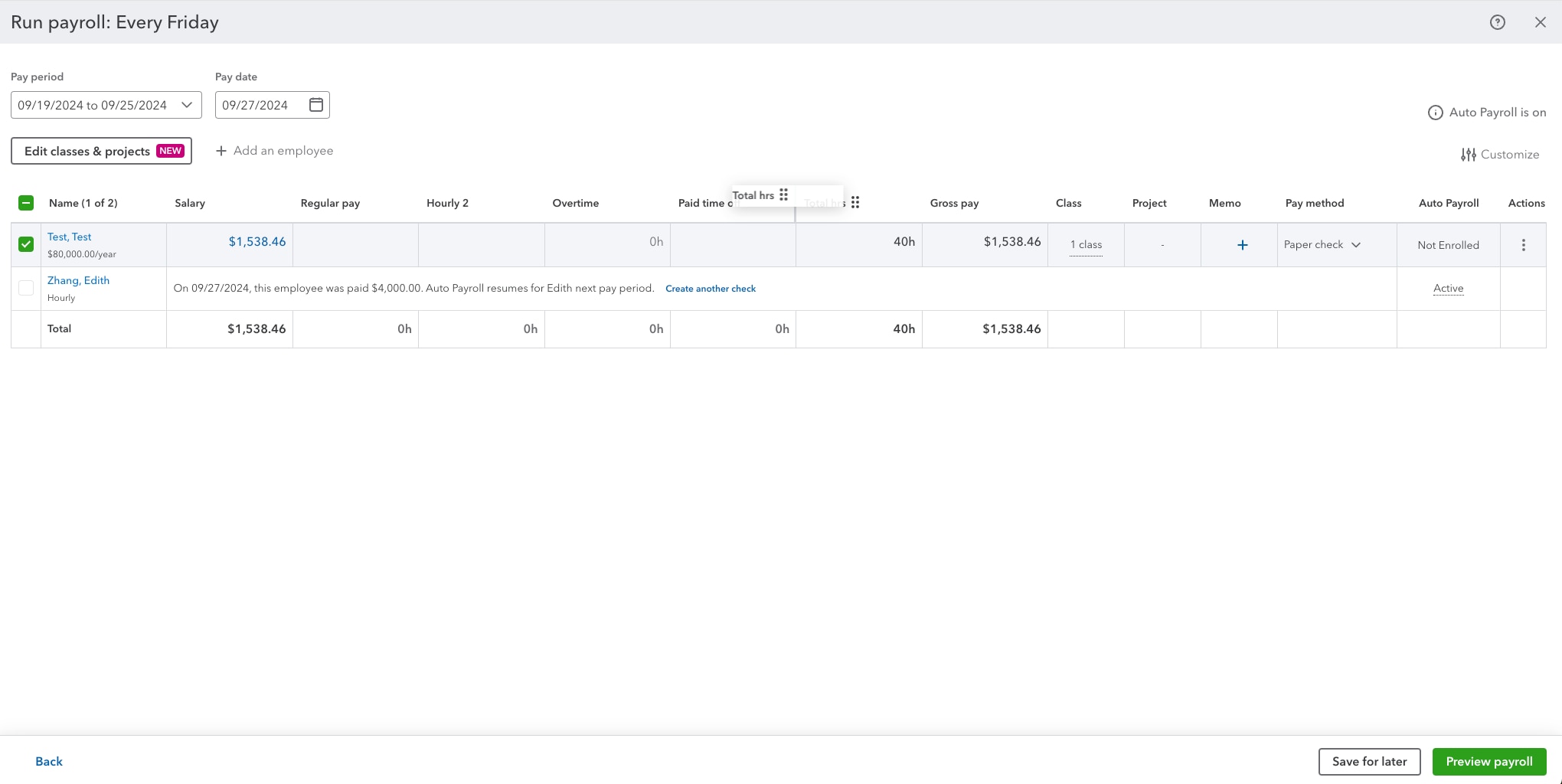

Customize column order and change payment type in QuickBooks Online Payroll

In a nutshell

You and your clients can now customize the order of your columns when entering hours in QuickBooks Online Payroll.

In the table on the Run payroll page, you can reposition any column, like Total hours, Salary, or Reimbursement. Want the table to match your time-tracking data? Easily move any column to the order you prefer.

The table also includes a Pay method column. This lists how each team member will be paid. To change how a team member is paid, select the dropdown in the Pay method column.

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Allow employees to edit direct deposit info in QuickBooks Workforce

In a nutshell

For your clients using QuickBooks Online Payroll, direct deposit info is now easier to manage.

Employees paid with direct deposit can now edit their own direct deposit info in QuickBooks Workforce rather than having to ask their employer to do it for them.

This option is active by default, but you or your client can turn it off at any time.

Note: QuickBooks Workforce must be enabled for an employee to change their direct deposit info. At this time, employees can edit their information in QuickBooks Workforce on the web but not through the mobile app.

Get enhanced payroll cost allocation for robust profit and loss insights

In a nutshell

Clients using QuickBooks Online Plus or Advanced can track and allocate payroll costs with precision using QuickBooks, QuickBooks Online Payroll Premium or Elite, and QuickBooks Time.* This detailed view of labor costs helps you and your clients make smarter business decisions.

During payroll processing, your clients can now track payroll costs by customer, project, or class, and split wages by multiple classes or projects within the same pay period. This enables them to run in-depth P&L reports by class, project, or customer, accurately reflecting their total labor costs. By implementing this tracking, your clients can split wages into multiple classes or projects, including hourly or salaried.

Clients will also save time when team members record hours with a specific class, project, or customer in QuickBooks Time. These hours will directly flow into payroll with this added info. They can also use this info to help identify mistakes while making paycheck corrections.

Also, payroll taxes and contributions will be automatically allocated to the correct project or class. This gives clients better visibility on actual labor costs in P&L reports.

Important pricing details and product information

QuickBooks Time: Time tracking available in QuickBooks Online Payroll Premium and Elite only.

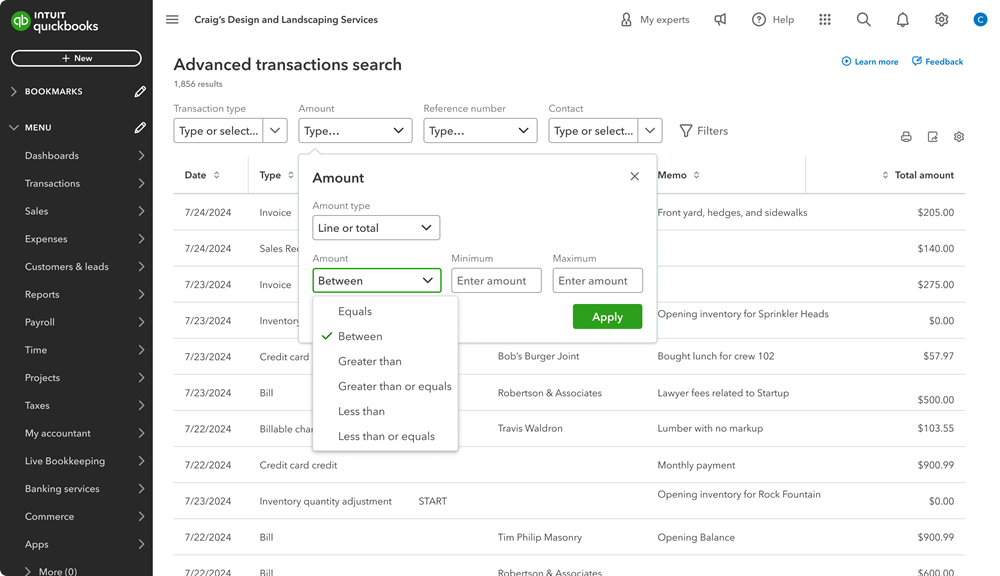

Explore an advanced search for transactions in QuickBooks Online

In a nutshell

It’s now even simpler for you and your clients to find specific transaction data with a new, modern interface that makes it easy to carry out advanced searches.

Whether you’re finding a recent payroll expense or checking if an invoice has been paid, you can apply the filters you need to complete more detailed queries.

Search for line amount, total amount, or line or total amount with redesigned Filters. You can also use the improved memo, description, and tracking number filters to find these transactions more easily.

In addition to these enhanced filters, you can now resize, customize, hide, and sort table columns in the improved advanced search to find the data you need. You can also change the height of rows and alternate row colors to personalize your search experience.

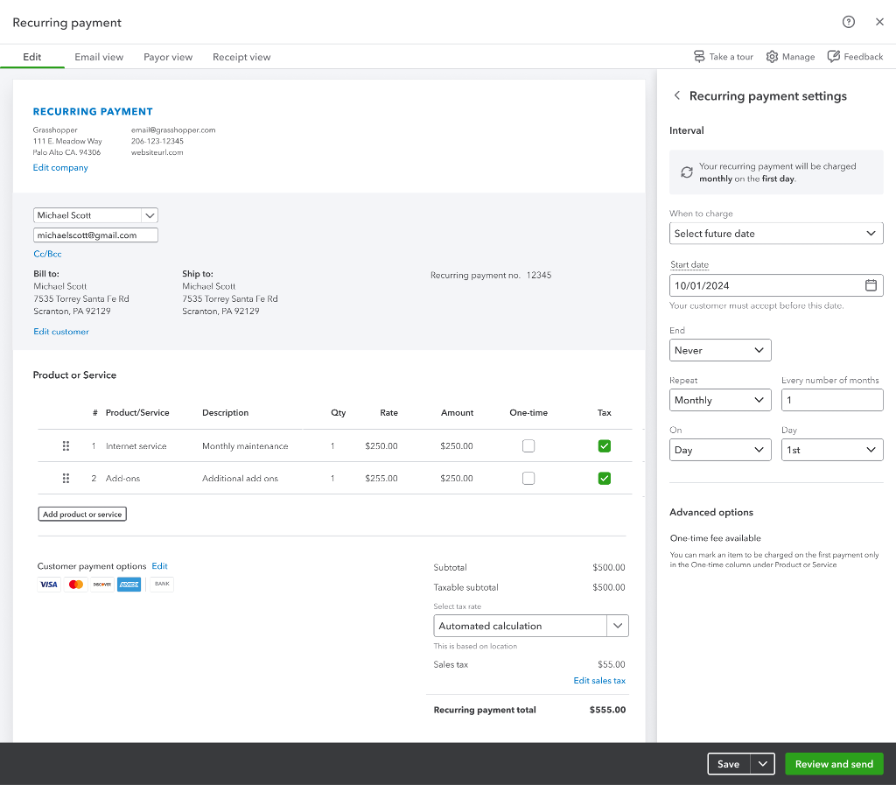

Help clients get paid automatically with recurring payments

In a nutshell

Has your client been invoicing customers for the same products or services regularly? If so, they can now set up recurring payments using QuickBooks Payments.

Your client no longer needs to wait for customers to pay invoices. When a client sets up recurring payments for a customer, QuickBooks will send the customer an email with a link to accept the terms and securely enter their ACH or credit card info. Then, the customer will be automatically charged each period, and the payments will be automatically matched in QuickBooks.

Your clients have the flexibility to set up recurring payments that charge daily, weekly, monthly, or annually. One-time fees, like initial setup fees, can be added to the first charge.

Recurring payments make it easier for your clients to get paid quickly and maintain a steady cash flow. Plus, their customers will appreciate the convenience of automatic payments, eliminating the need for manual invoices and follow-ups.

To access recurring payments, your clients must be U.S.-based QuickBooks Payments merchants.

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Not available in U.S. territories or outside the U.S.

Access tax adjustments in Intuit ProConnect Tax

In a nutshell

Have greater control over the books-to-tax process with Prep for Taxes in Intuit ProConnect Tax.

You can now review, reclassify, and remap your client’s trial balance data before applying it to their tax return. If you need to make adjustments, you can do so directly in ProConnect Tax rather than having to revisit the books. To reconcile any differences between your client’s books and their tax return, you can reclassify transactions and reconcile tax mapping. You can then use the new data to create tax adjustments to the corresponding schedule on Forms 1040, 1065, 1120, 1120S, and 990. Finally, you can generate a workpaper to document the changes for your records.

Your clients’ data in QuickBooks Online Accountant or QuickBooks Online will remain intact, even if you make adjustments. You can also create journal entries and new account types without affecting their books. This eliminates the need for error-prone manual processes or duplicate work, allowing you to efficiently and accurately handle tax adjustments for your clients.

Register for Intuit Connect

Formerly known as QuickBooks Connect, Intuit Connect is still the best place for accounting leaders to learn, network, and get inspired. The name change to Intuit Connect reflects the integrated platform’s ability to help businesses of all sizes start and grow. Accountants are the key advisors who help their clients succeed with the QuickBooks ecosystem.

Get inspired by influential speakers and expert-led sessions on topics like QuickBooks tools and services, Mailchimp, firm growth, client advisory, and more.

Save $600+ on group passes.

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.