Intuit® has launched a new QuickBooks® Payroll Certification just for accountants and bookkeepers! Not only will you have an in-depth look into the QuickBooks Payroll platform; you will have access to risk and compliance training that will help you more confidently provide payroll services for your clients.

New payroll training and certification exam

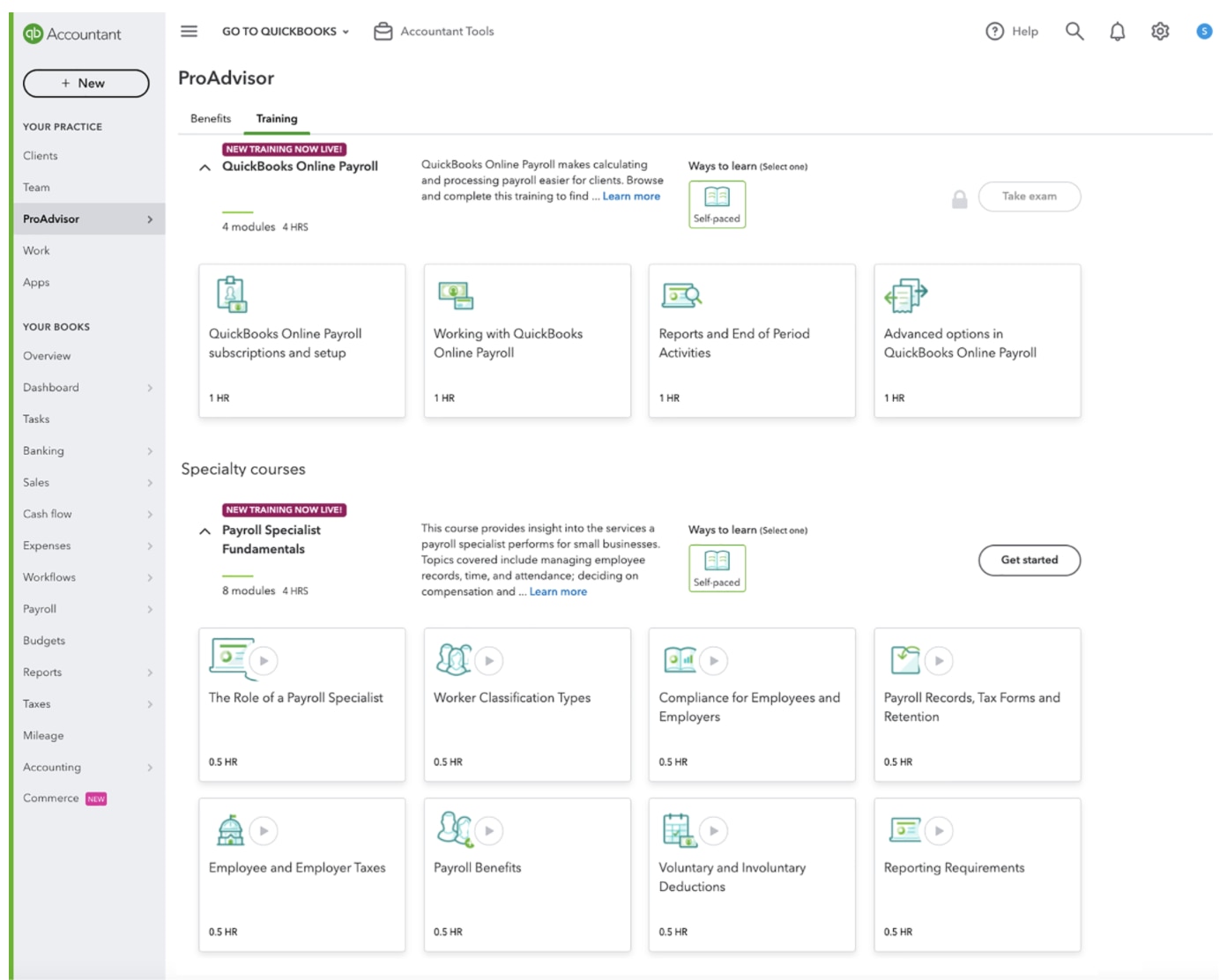

Along with the new certification exam, two new self-paced payroll training courses are now live. The QuickBooks Online Payroll course provides in-depth product training of key features to support your clients’ various payroll needs. The Payroll Specialist Fundamentals course is an overview of Payroll compliance and regulations that will provide any accounting professional new to payroll the foundational knowledge needed to confidently provide payroll services. The exam will test your product and compliance knowledge. Anyone who achieves a score of 80 percent or better will become a Certified ProAdvisor in QuickBooks Online Payroll.

Why should I get certified?

- Grow your business by offering payroll services. Make adding payroll services to your firm’s offering easy with the new Payroll Certification Exam. Learn the ins and outs of QuickBooks Online Payroll, and let us do the heavy lifting for you through automated tax payments/filings and auto payroll.

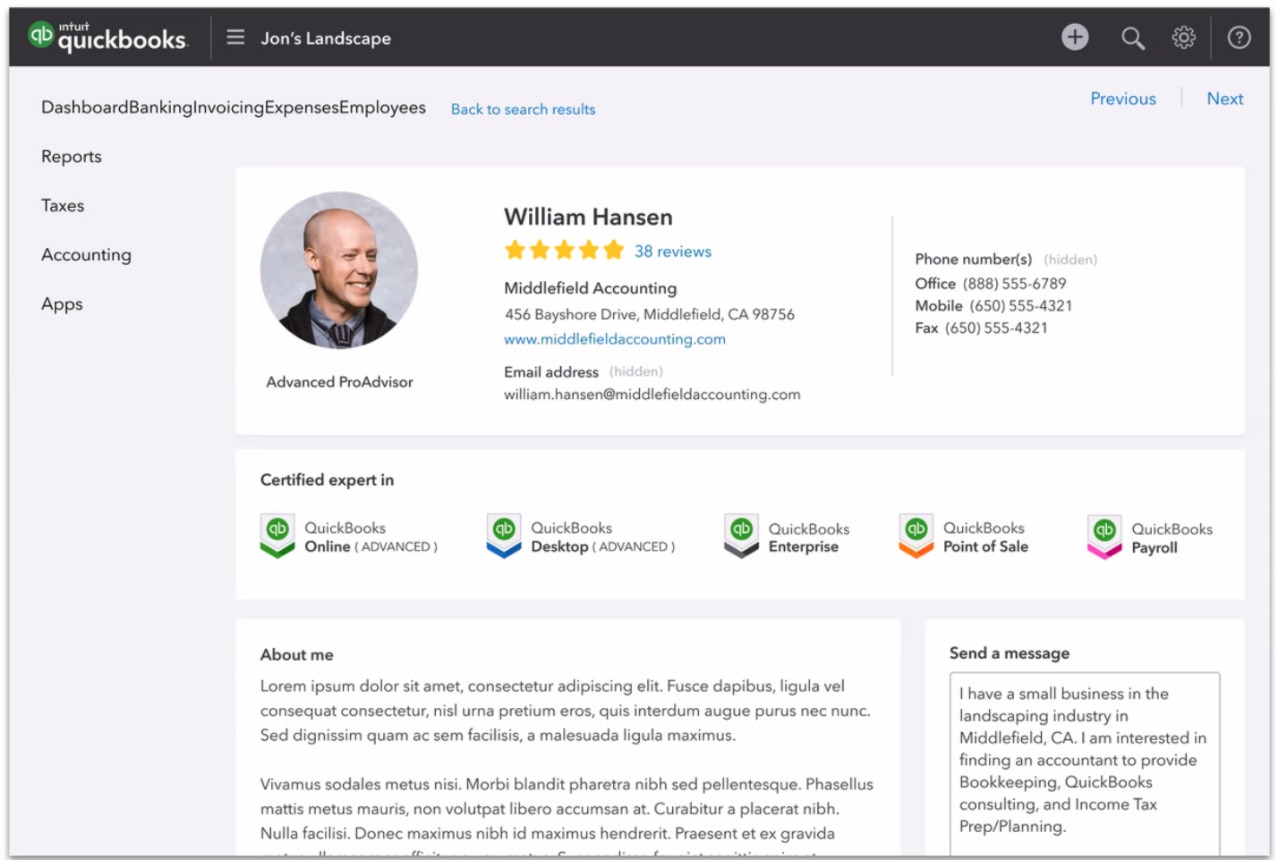

- Market your firm. Use your payroll certification badge as a marketing tool for your firm.

- Help clients find you. Set yourself apart as a payroll certified accounting pro on the Find-a-ProAdvisor directory, where you can list your firm’s services and watch the leads come through.

- Stay up to date on compliance and regulations. The new Payroll Specialist Fundamentals course will help you better advise your clients with up-to-date training on federal and state compliance for employees and employers.

- Train your staff. We’ll do the heavy lifting for you! Use the certification as a tool in getting your firm trained on how to execute payroll through QuickBooks Online Payroll.

Top topics that will be covered are:

- Federal and state compliance for employees and employers.

- Paying taxes and filing forms.

- How to set up and run payroll.