But, this confidence begins to unravel when more than 60% admit they didn’t realize how time-consuming payroll would be. Another 7 out of 10 say it’s equally challenging to stay on top of payroll tax and HR compliance laws. Given a choice, 6 in 10 prefer to leave payroll processing to the professionals.

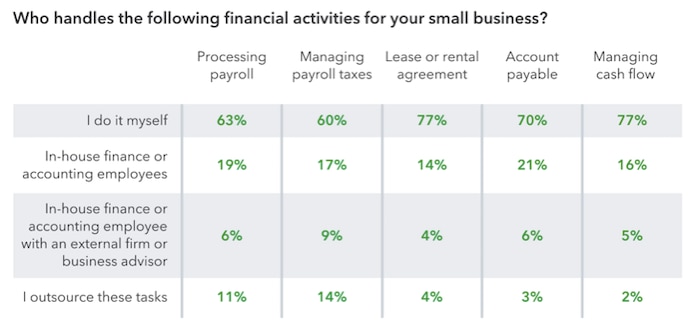

So, why don’t business owners outsource? Being the most suitable person to manage and perform financial tasks is more of a reaction than the cause, the survey says.

When asked why they choose to keep financial tasks to themselves or in-house, pricing plays a major role. But, price is far from being the only justification. Respondents say bad experiences have led them to see little value in outsourcing essential tasks. Other reasons point to more misconceptions. Business owners say:

- They don’t trust anyone to put their business first.

- They can’t find someone reliable to outsource work to.

- Their industry is too niche for an outsider to understand.

- They can’t find someone local to outsource work to.

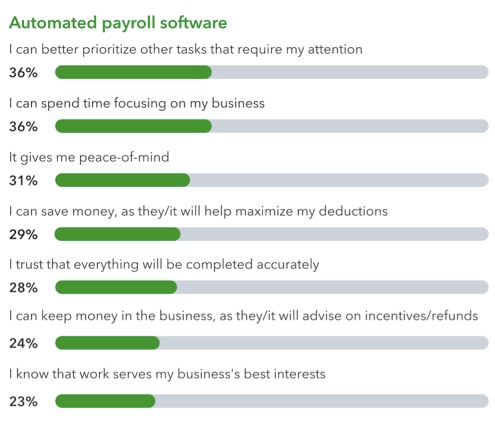

Technology, on the other hand, proves dependable. 72% of survey respondents have experienced the benefits of an automated payroll solution. The same cohort credits their solution for maximizing deductions and keeping money in the business. And, that’s improving their cash flow.

Use technology to top off a rich client experience

In the last decade, accounting professionals have been racing to create client experiences that go beyond completing tasks one could do with technology. Automation has done so well that business owners can rattle off the expected advantages, despite what they may be practicing in real life. To complete that experience, accounting professionals need to show their expertise and a human perspective.