Important offers, pricing details, and disclaimers

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/

*QuickBooks Online Accountant Revenue Share Program Offer Terms

Eligibility: QuickBooks Online Accountant (“QBOA”) firms in the United States only are eligible to apply to enroll in the “Revenue Share Program” and manage only new U.S.-based users for certain subscriptions (“Revenue Share Subscriptions”), services (“Revenue Share Products”) and add-ons (“Revenue Share Add-Ons”).

Revenue Share Subscriptions means the following QuickBooks products: QuickBooks Online Simple Start, Essentials, Plus, and Advanced, QuickBooks Online Payroll Core, Premium, and Elite,* QuickBooks Time, and QuickBooks Payments (“Revenue Share Products”).

*The Revenue Share Add-Ons means the per employee fee and multi-state charge for QuickBooks Online Payroll. The Revenue Share Subscriptions and Add-Ons do not include other optional add-on services for which Intuit charges a fee and is not already included in the base fee for the subscription.

Only one (1) QBOA user may enroll the QBOA firm in the Revenue Share Program per product. Intuit reserves the right to accept or decline any QBOA firm.

Offer Terms:

● QuickBooks Payroll, QuickBooks Time and QuickBooks: Each Revenue Share Program participant (“Participant”) is eligible to receive a 30% revenue share on the Revenue Share Subscriptions and 15% revenue share on the Revenue Share Add-Ons for the first 12 months of the paid subscription (“Revenue Share Payment(s)”), starting from the date the client starts paying for the subscription. The first month of the Revenue Share Subscriptions and Revenue Share Add-Ons, starting from the date of enrollment in the subscription, is free. After the first month of the Revenue Share Subscription, a 50% discount is applied to the then-current monthly list price for three (3) months, followed by the then-current list price. After the first month of the subscription, if the client enters their payment details and pays for the subscription, the firm is eligible to receive Revenue Share Payments for the subsequent 12 months only. Each Revenue Share Subscription must be client-billed, and cannot be paid for by the QBOA firm.

● QuickBooks Payments: Each Revenue Share Program participant (“Participant”) is eligible to receive 20% net revenue share from the transactions the accountant’s clients process in QuickBooks Payments for the first 5 years (“Revenue Share Payment(s)”), starting from the date you add your client to the Revenue Share program for QuickBooks Payments. The firm is eligible to receive Revenue Share Payments for the 5 years only. Eligible clients must meet the following requirements: 1) QuickBooks Online user for more than 2 years; 2) Not previously used QuickBooks Payments; 3) US based company, and 4) Remain in good standing with Intuit along with other criteria.

Revenue Share Program cannot be combined with any other Intuit offer. Offer valid for a limited time only, only in the U.S., and is non-transferable.

Termination. Intuit may terminate these terms or the Revenue Share Program or modify the terms of the Revenue Share Program for any reason and at any time, at Intuit’s sole discretion, without notice. Terms, conditions, pricing, special features, and service and support options are subject to change without notice.

**Features

QuickBooks Payments: QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

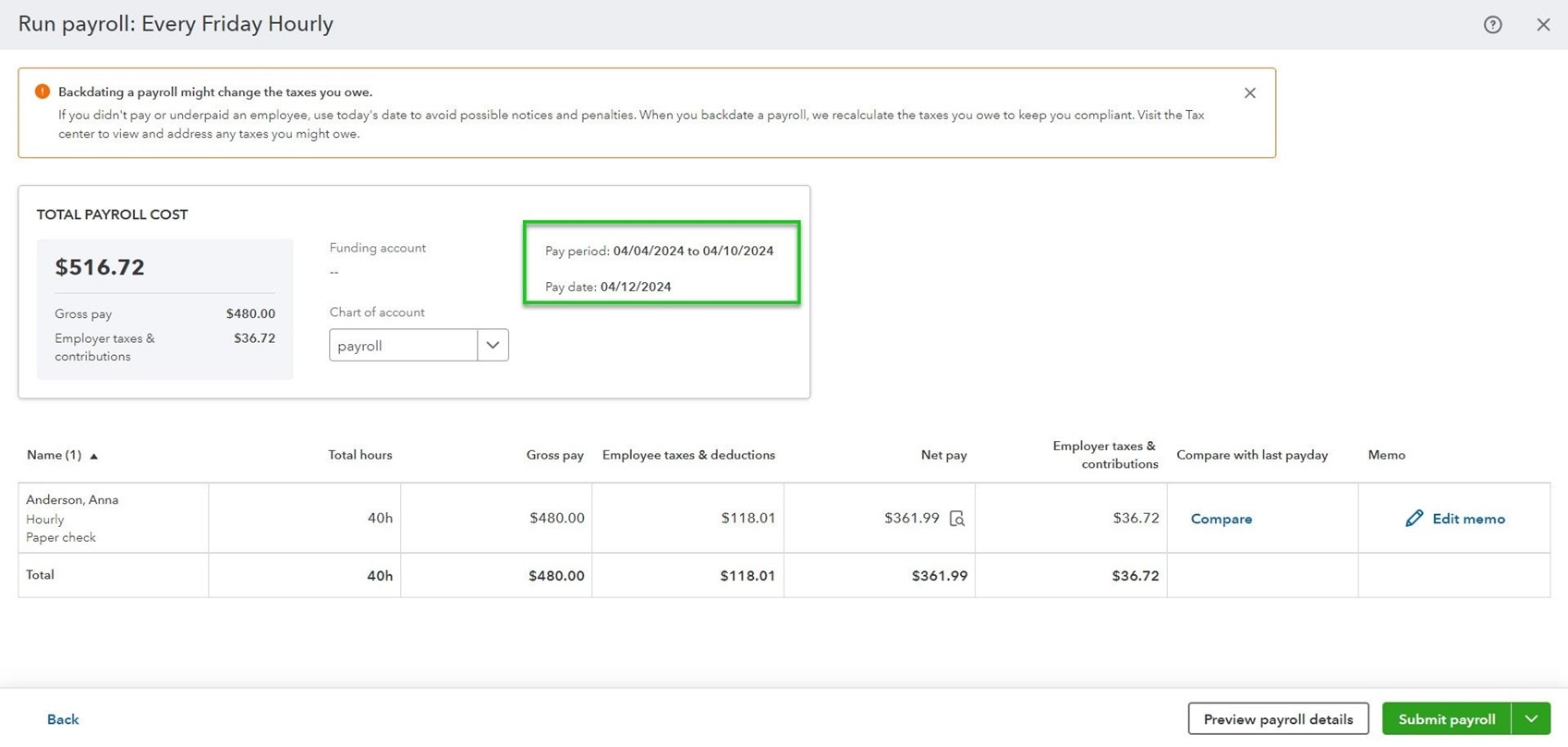

Payroll cost allocation: QuickBooks Online Plus or Advanced subscription required. Time tracking available in QuickBooks Online Payroll Premium and Elite only.

Spreadsheet Sync: Automatic refresh requires setup and will update workbooks or individual sheets every time you open the workbook or login to Spreadsheet Sync. See more details here.

Paycheck corrections after payroll: Currently available for open quarters before taxes have been filed, may not be available for certain situations. If using direct deposit, and money hasn’t moved, you can delete or edit paychecks to ensure the correct amount that should be withdrawn from your bank and deposited to the employees. If using direct deposit, and money has moved, corrections can only be used to void transactions but do not correct any money movement. Corrections can't be made on adjustment checks. Note: Corrections could result in tax over or underpayment, in which case the subscriber is responsible to take care of that separately.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.